-

Notifications

You must be signed in to change notification settings - Fork 3

Advanced Benchmarking Report

The Advanced benchmarking report is a unique opportunity to provide both the sub-grandees and accelerators better insight in project’s performance by leveraging the data acquired during the FI-IMPACT project and the experience of the consortium in the market research and advanced analytics areas. For this purpose two additional benchmarking tools have been developed. The first one, shown in the figure below, shows the selected project’s position in relation to other projects (including HPI and use-cases) across a selection of performance indicators and questionnaire attributes.

Along with those measurements, links to relevant Benchmark Success Stories are provided –FI-PPP Best Practice and selected proposals as Success Stories.

FI-IMPACT Performance Indicators Benchmark

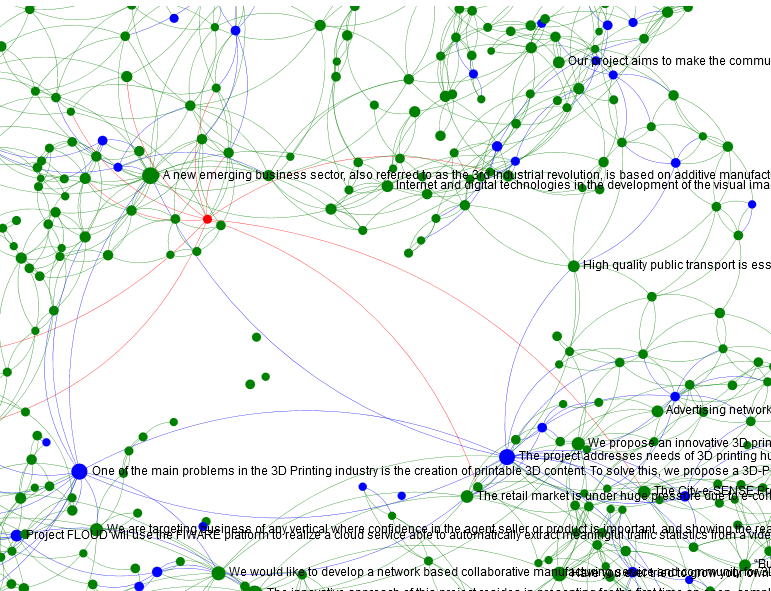

The more complex network graph, shown in the figure below, uses a complex approach to define a fuzzy “similarity” measure among projects. This similarity measure takes into account the project description (abstract), FI-WARE technology used, team competences, geographical distribution, market distribution/targeting and possibly additional content as well.

The similarity measure is then used to visualise project interrelation and distance with a network graph.

FI-IMPACT Similarity Benchmarking

Both approaches support several slicing and filtering methods through the data to define the analysis context (for example, “How would I perform in the selected market benchmarked over all known other projects in that market, targeting similar needs, geographically, etc.?”.)

These smart visualisations enable sub grantees and their mentors/reviewers how they “compete” with other projects and ideas, identify possible similarities, find opportunity windows, search for possible “partners” etc.

The main conceptual difference between those two graphs is that the first one relies on performance indicators, which encompass different assumptions about a good performance. In a way, the first graph is expert’s view and to some extent advice on the gap between “my project” and successful projects. On the other hand, the second graph finds similarities among project using a wide range of attributes and lets users make their own judgement about “good” or “bad” similarities.