An empirical SFC macroeconomic model for Italy using Bimets package

Authors: Rosa Canelli and Marco Veronese Passarella

Last change: 6 February 2024

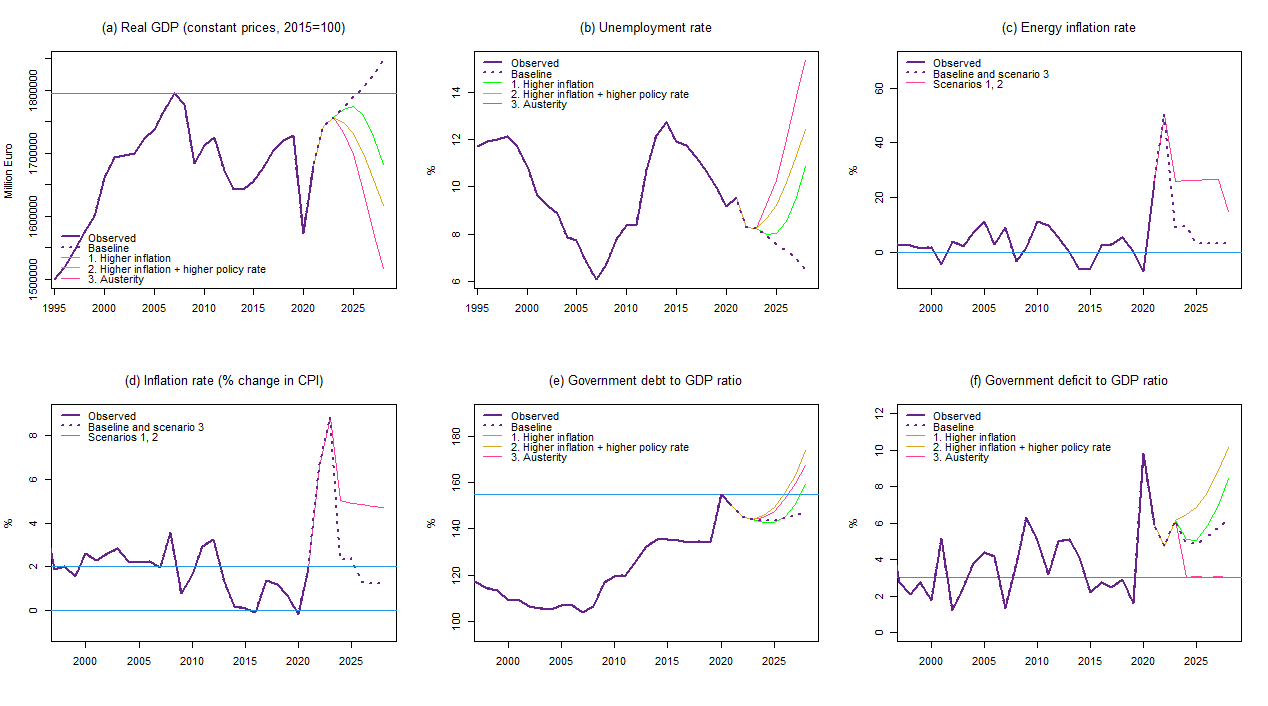

Description: This repository contains two types of code. The file named Italy_SFC_model.r replicates the baseline and the experiments discussed in: Canelli, R., Fontana, G., Realfonzo, R. and Veronese Passarella, M. (2022) Is the Italian government debt sustainable? Scenarios after the Covid-19 shock, Cambridge Journal of Economics. Notice that an early version of it was used to produce the simulations discussed in: Canelli, R., Fontana, G., Realfonzo, R. and Veronese Passarella, M. (2021) Are EU policies effective to tackle the Covid-19 crisis? The case of Italy, Review of Political Economy. The other (numbered) files allow replicating the baseline and the experiments discussed in: Canelli, R., Fontana, G., Realfonzo, R. and Veronese Passarella, M. (2024) Energy crisis, economic growth and public finance in Italy, Energy Economics. A detailed description of the latter is provided below.

- 1 Model and data

- 2 Accounting tables

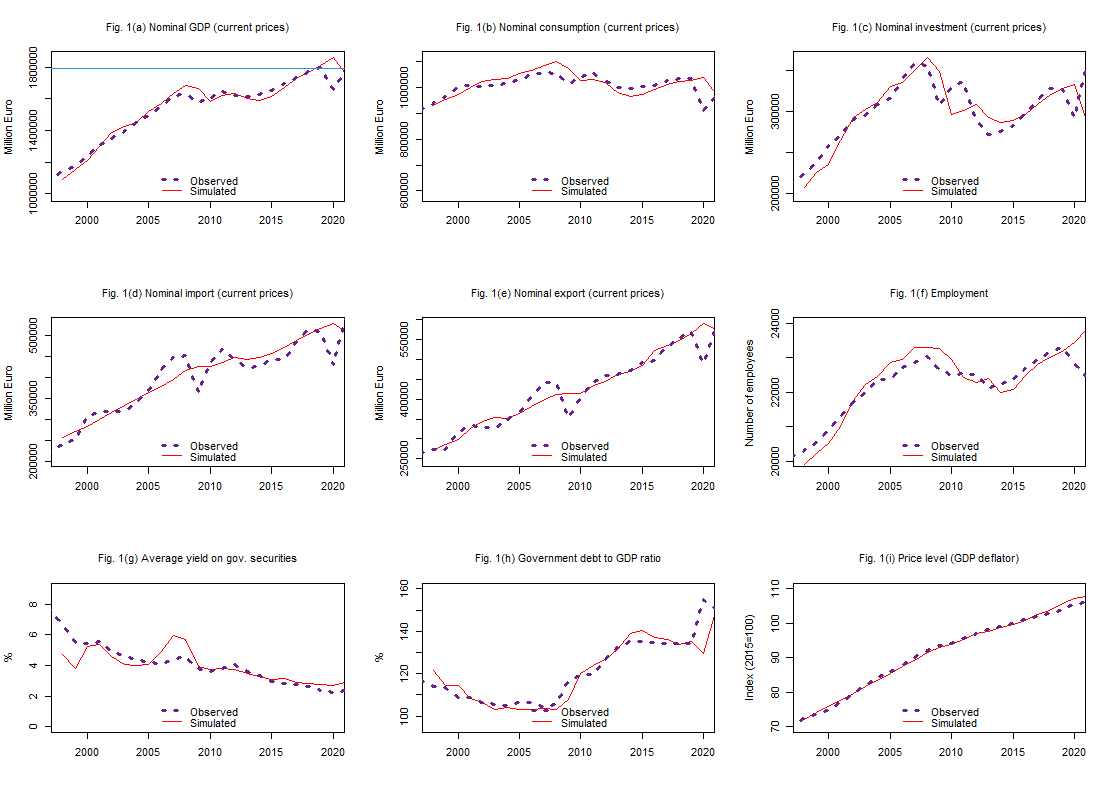

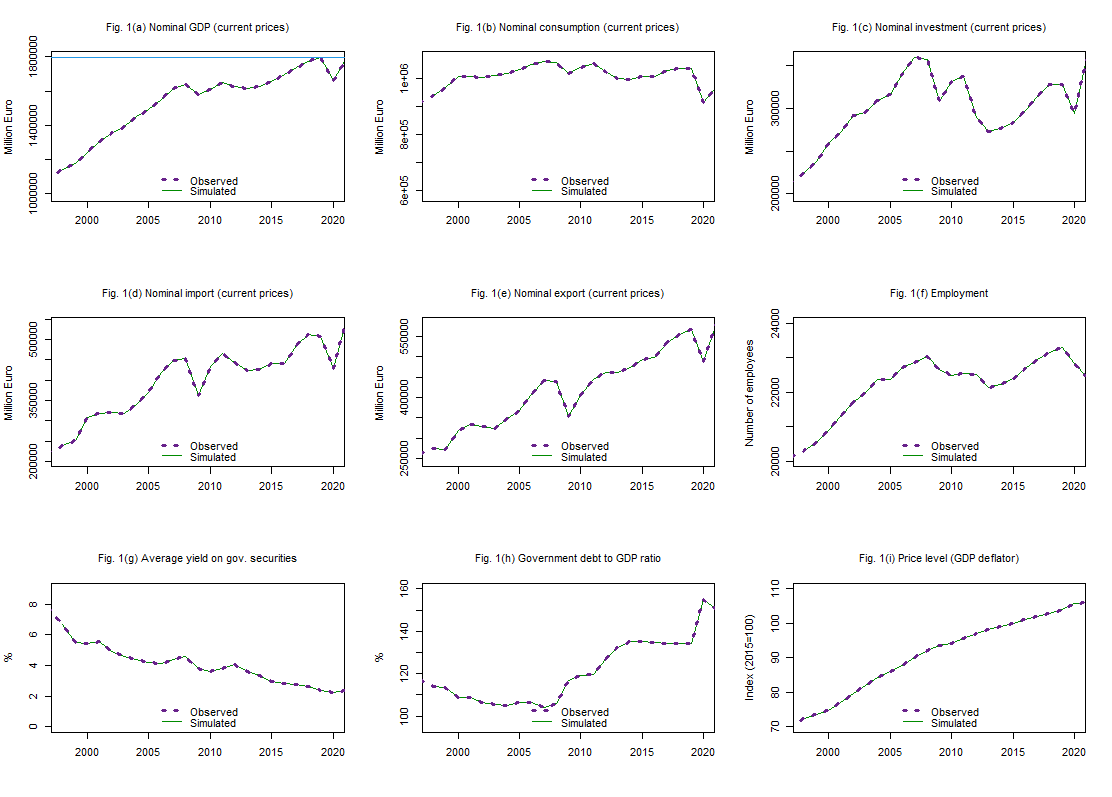

- 3 In-sample predictions

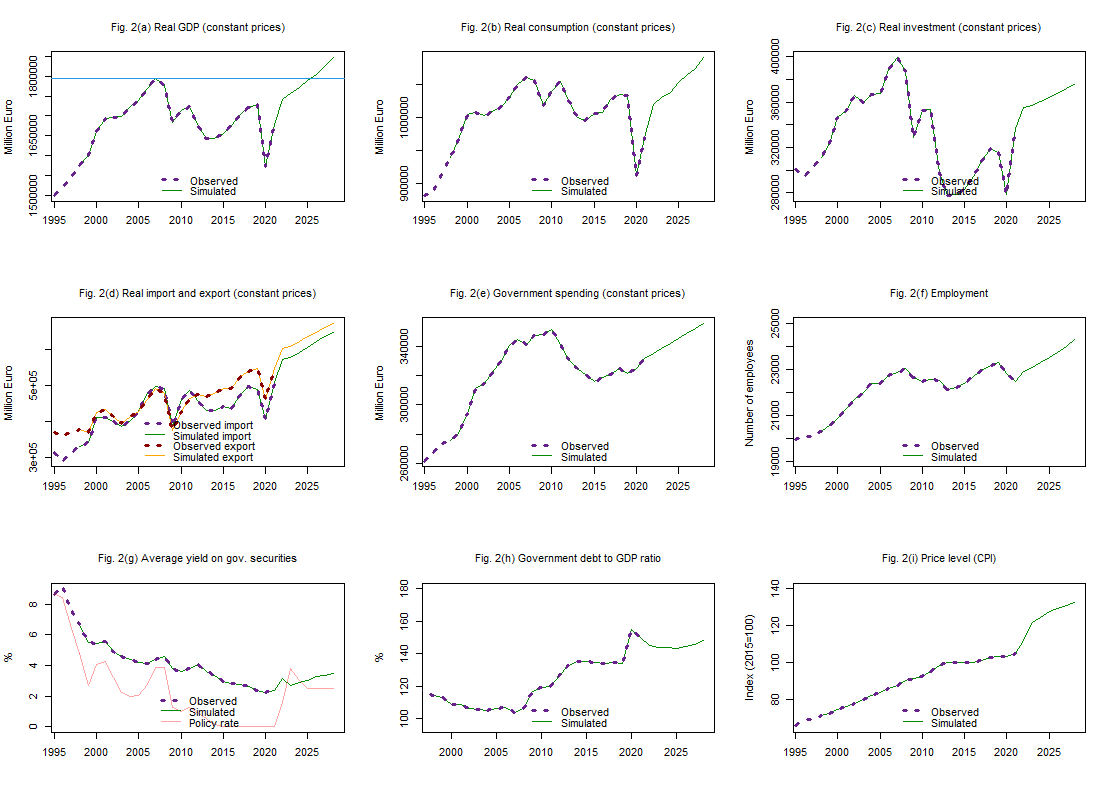

- 4 Out-of-sample predictions

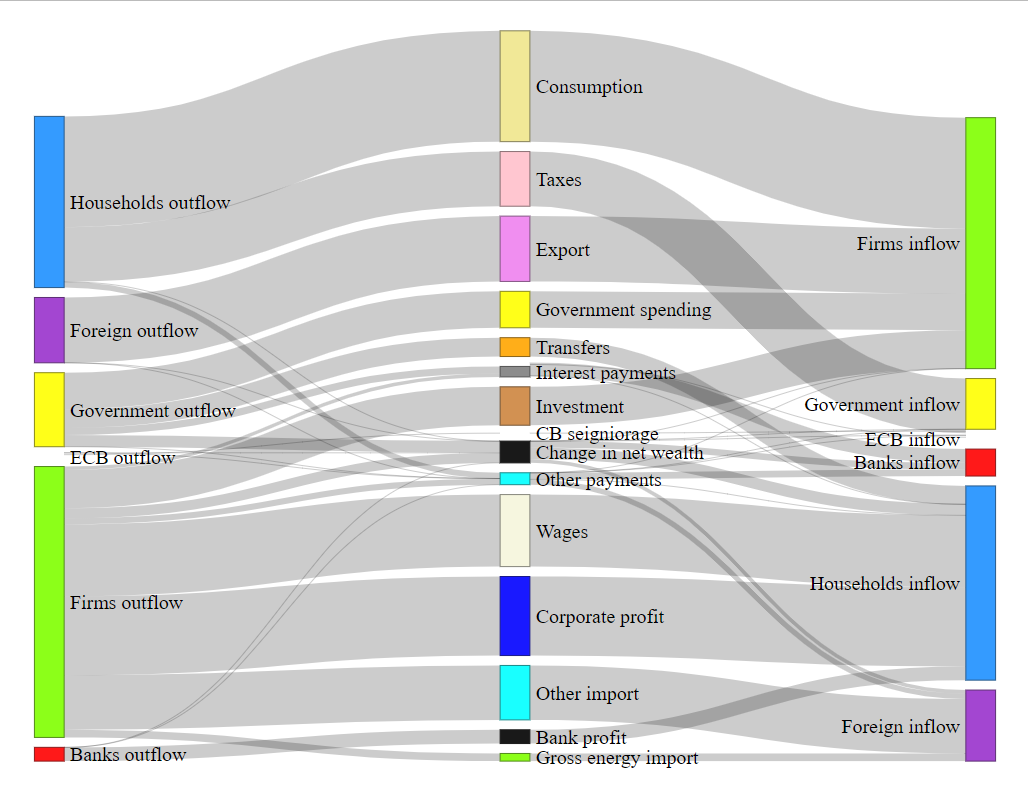

- 5 Model watertightness

- 6 Experiments

- 7 Quick execution

[Warning: work in progress] 🛠️

The model presented here is created using the R package named Bimets. You can install it from the Packages sub-pane within RStudio. We also recommend installing and loading the knitr package.

library(bimets)

library(knitr)Once packages have been loaded, the first step in creating the model is to define the structure of the economy, determining the level of aggregation implied by the desired accounting matrices. Subsequently, the density of the original matrices, as implied by the observed series, must be consistently reduced to limit the number of equations. Additionally, in the absence of information (e.g., on cross-sector interest payments), a decision must be made regarding which sector is paying whom. Available data must be reclassified accordingly - please refer to Veronese Passarella (2019), section 2, for additional information on the method for reclassifying Eurostat time series.

In our model, we consider six sectors (households, production firms, government, commercial banks, central bank, and the foreign sector) and six financial assets (cash, deposits, securities, loans, shares, and other net financial assests). The associated simplified balance sheet of Italy in 2021 is:

Figures are all expressed at current prices, million euros.

Similarly, the simplified or riclassified transactions-flow matrix of Italy in 2021 is:

where the entry named 'Other payments' allows aligning each sector's saving, calculated based on Eurostat's non-financial transactions, with the change in financial wealth as derived from Eurostat's financial balance sheets.

Note: The R code to create the tables above (using observed series) is presented in Section 2.

The second step to create the model is to import the data (observed series). Our code takes the observed series from a Dropbox folder, containing Eurostat data for Italy over the period 1995-2021.

#Upload data: time series for transactions-flow matrix and balance sheet

DataEE <- read.csv("https://www.dropbox.com/scl/fi/58un32aub0asx1tu1t53c/Data_Aalborg.csv?rlkey=642w2hwa8qo069nmn1rc848i2&dl=1") Running this chunk of code allows creating the dataset used by the model to estimate the coefficients and attribute initial values to the variables. Data are already classified to fit the two tables above.

| Year | CONS | INV | GOV | X | IM | Y | TAX | INVnet | TR | WB | INTh | INTlh | INTgh | INTm | INTf | INTg | INTgb | INTb | INTcb | INTrow | Ff | DIV | FUf | Fb | Fcb | YD | OPh | OPf | OPg | OPb | OPcb | OProw | Yrow | DEF1 | Hh | Hbd | Hs | Mh | Ms | Bh | Deb | Bb | Bcb | Bs | Brow | Lf | Lh | Ls | Eh | Es | OAh | OAf | OAg | OAb | OAcb | OArow | Vh | NVh | Vf | Vg | Vb | Vcb | Vrow | K | Rlh | Rl | Rb | Rstar | Prod | ProdR | Delta | Kappa | KappaN | Py | Pc | Exr | Exr42 | Exr42R | IMen | Pen | Pen2 | Pim | Pim_en | Py_row | RHO | w | gid | gkn | gy | Rbb | Rbrow | Rbh | Re | gw | CPI | PI | PIen | Nd | Ns |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1995 | 581704 | 198068 | 172298 | 243824 | 207651 | 988243 | 304502.9179 | 61690.466 | 32837 | 353786 | 94539 | 22058.98524 | 202553.2366 | -85955.25137 | 32051 | 101685.9999 | -29707.98536 | 110357.2512 | -85955.25137 | 14796 | 594208 | 435525 | 158683 | 110357.2512 | -85955.25137 | 709948 | -12593.3333 | -8198 | -26684.6667 | 108193.2514 | 9950 | -70667.25137 | 11869868.24 | 88273.33333 | 42951 | 3915 | -46866 | 642843 | -642843 | 407396 | 1179962.142 | 390724 | 106668 | -1179962.142 | 275174.142 | -480014 | -166659 | 646673 | 337925 | -337925 | 276065 | 104061 | 239854.142 | -483688 | -80593 | -55699.142 | 1707180 | 1540521 | -713878 | -940108 | -85219 | -20791 | 219475 | 2964729 | 0.13236 | 0.066770969 | 0.086177341 | 0.086875 | 49.59938769 | 75.25206367 | 0.046 | 0.333333333 | 0.34940601 | 65.911 | 65.5 | 1.308 | 77.5 | 92.40989 | 15433.334 | 49.50860467 | 56.1921773 | 64.63870703 | 51.80703164 | 55.27815729 | 0.006090134 | 17.75633015 | 0.037188395 | 0.023283628 | 0.051381348 | -0.076033173 | 0.053769587 | 0.497190048 | 1.288821484 | 0.074269715 | 0.045801527 | 0.045075936 | 0 | 19924.5 | 22560.6 |

| 1996 | 611812 | 202429 | 184246 | 247921 | 200535 | 1045873 | 339106.6832 | 66051.466 | 32914 | 378499 | 96012 | 21362.90615 | 196733.19 | -79358.28384 | 28312 | 108261.0004 | -21732.90575 | 107300.2842 | -79358.28384 | 12619 | 677120 | 514076 | 163044 | 107300.2842 | -79358.28384 | 763826 | -25868.601 | 38058 | -49285.399 | -15041 | 976 | 51161 | 12432671.32 | 65672.601 | 43739 | 4488 | -48227 | 666811 | -666811 | 490407 | 1245634.743 | 439727 | 97545 | -1245634.743 | 217955.743 | -482938 | -176991 | 659929 | 370549 | -370549 | 298020 | 100224 | 190568.743 | -537593 | -69133 | 17913.257 | 1869526 | 1692535 | -753263 | -1055066 | -100260 | -19815 | 235869 | 3030780.466 | 0.128183333 | 0.058624503 | 0.091749554 | 0.084375 | 52.20568342 | 75.79002268 | 0.046 | 0.345083721 | 0.369781837 | 68.882 | 68.5 | 1.27 | 86.1 | 101.71875 | 19682.28 | 51.77617435 | 58.72509228 | 68.18104965 | 54.64617037 | 58.3075213 | 0.006730543 | 18.8931151 | 0.022017691 | 0.022279091 | 0.058315617 | -0.055622142 | 0.045858233 | 0.482904079 | 1.521272472 | 0.064021391 | 0.045801527 | 0.045075936 | 0.045801527 | 20033.7 | 22737.8 |

| 1997 | 645631 | 213028 | 193160 | 263802 | 223262 | 1092359 | 348240.7178 | 73612.09856 | 35143 | 397066 | 79460 | 18600.83965 | 153836.1258 | -55775.28619 | 28260 | 94403.00059 | -10613.83906 | 92022.28678 | -55775.28619 | 6956 | 701730 | 567744 | 133986 | 92022.28678 | -55775.28619 | 914897 | 91702.431 | 34697 | -29706.431 | -41340 | 407 | -55760 | 13182538.9 | 30240.569 | 46923 | 4901 | -51824 | 638201 | -638201 | 559168 | 1275875.312 | 441022 | 92006 | -1275875.312 | 183679.312 | -493212 | -188351 | 681563 | 448317 | -448317 | 457543 | 109224 | 160862.312 | -630885 | -59590 | -37154.312 | 2150152 | 1961801 | -832305 | -1115013 | -141600 | -19408 | 146525 | 3104392.565 | 0.105094833 | 0.057297876 | 0.075787064 | 0.063958333 | 54.29705441 | 76.8524924 | 0.046 | 0.351875279 | 0.377800508 | 70.651 | 69.8 | 1.134 | 87.5 | 100.6284 | 20382.45 | 52.75878788 | 60.23324663 | 71.82719165 | 57.56850286 | 61.42565315 | 0.007679399 | 19.73665636 | 0.052359099 | 0.024288166 | 0.044447079 | -0.024137338 | 0.031914736 | 0.313690722 | 1.532169834 | 0.044648077 | 0.018978102 | 0.0256816 | 0.018978102 | 20118.2 | 22865.7 |

| 1998 | 679941 | 224747 | 199624 | 274042 | 239497 | 1138857 | 363999.2758 | 81944.94203 | 58835 | 395312 | 62467 | 16279.38098 | 122672.1812 | -43925.80025 | 15700 | 85175.00053 | -1030.380451 | 74874.80078 | -43925.80025 | 7459 | 835871 | 745987 | 89884 | 74874.80078 | -43925.80025 | 958284 | -15192.525 | 108026 | -43185.475 | -124795 | -1730 | 76877 | 13879204.32 | 23560.525 | 50305 | 5521 | -55826 | 609760 | -609760 | 513956 | 1299435.837 | 577525 | 78127 | -1299435.837 | 129827.837 | -504062 | -205507 | 709569 | 562925 | -562925 | 708705 | 99819 | 117676.837 | -949250 | -43439 | 66488.163 | 2445651 | 2240144 | -967168 | -1181759 | -266395 | -21138 | 196316 | 3186337.507 | 0.086431083 | 0.031146962 | 0.066758091 | 0.047916667 | 56.0861343 | 77.52271562 | 0.046 | 0.357418823 | 0.384542359 | 72.348 | 71.2 | 1.121 | 90.4 | 102.12797 | 12666.42 | 81.00496309 | 61.68001765 | 74.8634512 | 60.00202299 | 64.02222168 | 0.009054382 | 19.4682229 | 0.055011548 | 0.02639645 | 0.042566592 | -0.002336347 | 0.040608819 | 0.219383408 | 1.663972145 | -0.013600757 | 0.020057307 | 0.024019476 | 0.535383324 | 20305.5 | 23111.2 |

| 1999 | 710248 | 237770 | 206206 | 272643 | 251716 | 1175151 | 356021.3367 | 91198.4747 | 62587 | 410340 | 54993 | 13040.49806 | 115548.0802 | -47514.58213 | 13073 | 71724.00058 | -5035.497487 | 68592.58271 | -47514.58213 | 8726 | 560877 | 558925 | 1952 | 68592.58271 | -47514.58213 | 926019 | 126602.754 | -190861 | 58330.246 | 12396 | -1685 | -4783 | 14675566.04 | 32010.246 | 56333 | 5795 | -62128 | 610642 | -610642 | 438251 | 1331446.083 | 610011 | 75770 | -1331446.083 | 207414.083 | -572790 | -239433 | 812223 | 750109 | -750109 | 840013 | 119913 | 176007.083 | -1071386 | -36465 | -28082.083 | 2695348 | 2455915 | -1202986 | -1155439 | -253999 | -22823 | 179332 | 3277535.981 | 0.06345525 | 0.022823373 | 0.055196262 | 0.027083333 | 57.17411294 | 77.83026537 | 0.046 | 0.358547094 | 0.386592589 | 73.46 | 72.3 | 1.066 | 91.8 | 101.55784 | 16561.2 | 92.65119048 | 62.62804911 | 77.66434745 | 62.24690268 | 66.41751068 | 0.009490012 | 19.96409441 | 0.057945156 | 0.028621725 | 0.031868795 | -0.008719099 | 0.067212088 | 0.224820958 | 0.992894258 | 0.025470815 | 0.015449438 | 0.015370155 | 0.143771776 | 20553.9 | 23279.3 |

| 2000 | 751730 | 259037 | 220195 | 318172 | 307621 | 1241513 | 375224.8494 | 108270.3449 | 66311 | 427487 | 53814 | 16814.76105 | 108571.6979 | -37942.93688 | 17088 | 72578.99948 | -8496.761572 | 63348.93636 | -37942.93688 | 10447 | 780481 | 560823 | 219658 | 63348.93636 | -37942.93688 | 925612 | 129052.913 | -16457 | 14867.087 | -241870 | -274 | 114681 | 17137543.71 | 21803.087 | 59394 | 6644 | -66038 | 631780 | -631780 | 503331 | 1353249.17 | 557289 | 85497 | -1353249.17 | 207132.17 | -641875 | -273340 | 915215 | 747248 | -747248 | 961384 | 146758 | 190874.17 | -1343237 | -42556 | 86776.83 | 2903137 | 2629797 | -1242365 | -1162375 | -495869 | -23097 | 293909 | 3385806.326 | 0.070227417 | 0.026622006 | 0.054511407 | 0.040416667 | 59.46968826 | 79.53044862 | 0.046 | 0.366681635 | 0.397059351 | 74.776 | 74.2 | 0.924 | 88 | 96.48973 | 34898.31 | 94.79664835 | 63.75 | 79.69396408 | 63.8736124 | 68.15321166 | 0.010516319 | 20.47704585 | 0.08944358 | 0.033034068 | 0.056471041 | -0.013928866 | 0.050367843 | 0.24773862 | 0.747655341 | 0.0256937 | 0.026279391 | 0.017914511 | 0.02315629 | 20876.4 | 23418.8 |

| 2001 | 775878 | 271825 | 239959 | 334498 | 318022 | 1304138 | 343517.9719 | 116077.909 | 68186 | 451041 | 52025 | 19920.33585 | 99117.42021 | -27172.08436 | 16530 | 75157.99956 | -7151.336287 | 56471.08392 | -27172.08436 | 10364 | 821681 | 614287 | 207394 | 56471.08392 | -27172.08436 | 720897 | -177595.112 | -14886 | 854.112 | 192428 | -1733 | 932 | 18063016.94 | 66957.112 | 49167 | 8156 | -57323 | 690239 | -690239 | 566966 | 1420206.282 | 534466 | 86879 | -1420206.282 | 231895.282 | -688808 | -303134 | 991942 | 736025 | -736025 | 835553 | 118037 | 191728.282 | -1147766 | -54386 | 56833.718 | 2877950 | 2574816 | -1306796 | -1228478 | -303441 | -24830 | 288729 | 3501884.235 | 0.0728775 | 0.023997979 | 0.055538922 | 0.0425 | 61.21133041 | 79.44880318 | 0.046 | 0.372410369 | 0.40375049 | 77.045 | 75.9 | 0.896 | 89.9 | 97.08403 | 34288.28 | 98.23146825 | 60.81 | 83.42047245 | 66.86035743 | 71.34007175 | 0.011816197 | 21.17016733 | 0.049367465 | 0.034283682 | 0.050442484 | -0.012832366 | 0.050035685 | 0.19692294 | 0.822065767 | 0.033848705 | 0.022911051 | 0.030343961 | 0.036233558 | 21305.5 | 23573.9 |

| 2002 | 798351 | 291267 | 250419 | 329564 | 319342 | 1350259 | 391298.2531 | 130180.3252 | 71440 | 470108 | 46028 | 19814.37917 | 81591.92619 | -15749.54702 | 17230 | 70159.00011 | -9526.379064 | 43267.54713 | -15749.54702 | 13843 | 811498 | 594283 | 217215 | 43267.54713 | -15749.54702 | 858604 | 24775.706 | -51423 | -21476.706 | -59291 | -933 | 108348 | 17984691 | 16469.294 | 53408 | 8970 | -62378 | 716998 | -716998 | 637330 | 1436675.576 | 511446 | 65401 | -1436675.576 | 222498.576 | -716643 | -336487 | 1053130 | 777177 | -777177 | 786643 | 112972 | 170251.576 | -1219280 | -28786 | 178199.424 | 2971556 | 2635069 | -1380848 | -1266424 | -362732 | -25763 | 400698 | 3632064.56 | 0.065365083 | 0.024042654 | 0.04940057 | 0.032083333 | 62.23624958 | 78.21867053 | 0.046 | 0.347 | 0.404172649 | 79.567 | 77.9 | 0.946 | 92.2 | 99.27912 | 32653.125 | 105.7765564 | 63.15 | 86.39226109 | 69.24220501 | 73.88150563 | 0.012510495 | 21.66825684 | 0.071523958 | 0.037174366 | 0.035365122 | -0.017824107 | 0.059695048 | 0.143909734 | 0.807422302 | 0.023527897 | 0.026350461 | 0.032734116 | 0.076809278 | 21695.7 | 23902.1 |

| 2003 | 828304 | 295388 | 264649 | 324994 | 318642 | 1394693 | 393258.1745 | 128313.0302 | 74195 | 490889 | 47510 | 19618.3698 | 90145.08292 | -23016.71312 | 14382 | 66123.00043 | -14327.36938 | 42689.71355 | -23016.71312 | 13322 | 990303 | 724781 | 265522 | 42689.71355 | -23016.71312 | 890185 | -96621.539 | 100881 | 29264.539 | -78778 | -279 | 45533 | 16579854.78 | 34725.539 | 64267 | 8975 | -73242 | 754034 | -754034 | 642341 | 1471401.115 | 511490 | 68819 | -1471401.115 | 248751.115 | -773097 | -371352 | 1144449 | 747473 | -747473 | 860187 | 109856 | 199516.115 | -1352390 | -21619 | 204449.885 | 3068302 | 2696950 | -1410714 | -1271885 | -441510 | -26042 | 453201 | 3760377.591 | 0.0583035 | 0.018603099 | 0.046025005 | 0.0225 | 63.4081062 | 77.25912151 | 0.046 | 0.370891743 | 0.402510012 | 82.072 | 80.1 | 1.131 | 98.4 | 105.94827 | 34191.43 | 105.3707108 | 64.38 | 89.12955539 | 71.43610862 | 76.22240308 | 0.011902646 | 22.31770135 | 0.01414853 | 0.03532785 | 0.032907761 | -0.028013455 | 0.059874541 | 0.141441769 | 0.932581638 | 0.029972162 | 0.028241335 | 0.031482901 | -0.00383682 | 21995.5 | 24141.3 |

| 2004 | 856707 | 308799 | 278255 | 348699 | 340141 | 1452319 | 380777.1062 | 135821.6308 | 74916 | 509540 | 46295 | 20447.26004 | 84747.52034 | -18005.2603 | 14173 | 64586.99987 | -14956.26017 | 37669.26017 | -18005.2603 | 12801 | 1049131 | 882027 | 167104 | 37669.26017 | -18005.2603 | 1041694 | -127976.154 | 120525 | -14715.846 | -22910 | 694 | 44383 | 16589586.29 | 54986.154 | 76070 | 8639 | -84709 | 784680 | -784680 | 718263 | 1526387.269 | 481986 | 74525 | -1526387.269 | 251613.269 | -806836 | -421412 | 1228248 | 857892 | -857892 | 866444 | 112319 | 184800.269 | -1398613 | -15164 | 250213.731 | 3303349 | 2881937 | -1552409 | -1341587 | -464420 | -25348 | 501827 | 3896199.221 | 0.055061667 | 0.017566147 | 0.043894897 | 0.02 | 64.93945681 | 77.06758223 | 0.046 | 0.372752757 | 0.404838856 | 84.263 | 81.9 | 1.244 | 100.4 | 107.67591 | 38846.224 | 96.41309005 | 68.91 | 91.86997485 | 73.632517 | 78.56597314 | 0.011009584 | 22.78373472 | 0.045401303 | 0.036119147 | 0.041318054 | -0.029240572 | 0.051461076 | 0.131935406 | 1.180011853 | 0.020881782 | 0.02247191 | 0.026696072 | -0.085010537 | 22364.2 | 24277.5 |

| 2005 | 885949 | 316194 | 292969 | 367451 | 368928 | 1493635 | 388702.5627 | 136968.8358 | 76130 | 531929 | 47503 | 22393.55976 | 90820.76384 | -20924.20408 | 15074 | 64506.99964 | -16365.56012 | 42026.20372 | -20924.20408 | 10976 | 970860 | 915219 | 55641 | 42026.20372 | -20924.20408 | 1219425 | -4679.641 | 24228 | 9482.641 | 14648 | -8930 | -34749 | 17493109.5 | 65827.641 | 89146 | 8737 | -97883 | 822325 | -822325 | 735715 | 1592214.91 | 499382 | 82215 | -1592214.91 | 274902.91 | -876585 | -479078 | 1355663 | 1057758 | -1057758 | 989547 | 121381 | 194282.91 | -1491229 | -18610 | 204628.09 | 3694491 | 3215413 | -1812962 | -1397932 | -449772 | -34278 | 479531 | 4033168.057 | 0.05313935 | 0.017196279 | 0.042261228 | 0.020208333 | 66.79493773 | 77.70648192 | 0.046 | 0.370337903 | 0.401841653 | 85.958 | 83.7 | 1.244 | 99.3 | 105.95688 | 47940.26 | 75.45 | 76.69 | 94.2 | 75.5 | 80.55857946 | 0.010624753 | 23.78771549 | 0.023947616 | 0.035154474 | 0.028448295 | -0.03395443 | 0.043622501 | 0.126444998 | 1.066823097 | 0.04406568 | 0.021978022 | 0.02011559 | -0.217429916 | 22361.5 | 24238.8 |

| 2006 | 921983 | 340933 | 302522 | 406392 | 419143 | 1552687 | 412935.4616 | 155407.2694 | 84673 | 555830 | 50027 | 26932.7072 | 101583.2882 | -24623.58098 | 19164 | 65618.99958 | -24421.70762 | 46298.58056 | -24623.58098 | 13081 | 681954 | 645212 | 36742 | 46298.58056 | -24623.58098 | 1196782 | 227676.881 | -295739 | 49413.119 | -108750 | -3773 | 131172 | 18391491.59 | 64502.119 | 103968 | 10322 | -114290 | 879188 | -879188 | 735374 | 1656717.029 | 487660 | 93789 | -1656717.029 | 339894.029 | -954392 | -541251 | 1495643 | 1289471 | -1289471 | 1023462 | 126710 | 243696.029 | -1672959 | -17550 | 296640.971 | 4031463 | 3490212 | -2117153 | -1413021 | -558522 | -38051 | 636535 | 4188575.327 | 0.056217792 | 0.020079799 | 0.041212401 | 0.027916667 | 68.3704904 | 77.88491115 | 0.046 | 0.370695733 | 0.403542447 | 87.784 | 85.6 | 1.256 | 99.3 | 105.4757 | 61681.2 | 95.70833333 | 78.98 | 98.4 | 95.7 | 82.64410275 | 0.011740379 | 24.47522886 | 0.078239941 | 0.038532307 | 0.039535763 | -0.04890386 | 0.047584073 | 0.138074238 | 0.609980733 | 0.028902034 | 0.022700119 | 0.021242933 | 0.26850011 | 22709.9 | 24364.2 |

| 2007 | 953816 | 359238 | 307266 | 441837 | 447317 | 1614840 | 465321.4558 | 166563.535 | 78465 | 576340 | 56865 | 34286.6271 | 118836.814 | -27685.1869 | 30044 | 73006.99985 | -45126.62725 | 46889.18675 | -27685.1869 | 26982 | 998664 | 657999 | 340665 | 46889.18675 | -27685.1869 | 679025 | -272211.731 | -9792 | 26685.731 | 144725 | -6743 | 117336 | 18332622.93 | 21101.731 | 112983 | 11364 | -124347 | 915020 | -915020 | 762538 | 1677818.76 | 462908 | 93824 | -1677818.76 | 358548.76 | -1071324 | -602022 | 1673346 | 1199296 | -1199296 | 827606 | 134894 | 270381.76 | -1646395 | -14271 | 427784.24 | 3817443 | 3215421 | -2135726 | -1407437 | -413797 | -44794 | 786333 | 4355138.862 | 0.063347 | 0.028043804 | 0.044067272 | 0.038541667 | 70.68339892 | 78.57203081 | 0.046 | 0.370789555 | 0.40412414 | 89.96 | 87.3 | 1.371 | 101 | 106.39722 | 59734.24 | 94.025 | 86.23 | 98.9 | 94 | 85.39684094 | 0.012419401 | 25.22706282 | 0.053690901 | 0.039766155 | 0.040029317 | -0.092537069 | 0.079383566 | 0.161600511 | 0.510286001 | 0.030718159 | 0.019859813 | 0.024788116 | -0.017588158 | 22846.1 | 24327 |

| 2008 | 973266 | 356666 | 320333 | 439932 | 452498 | 1637699 | 457702.286 | 156329.6124 | 81770 | 595572 | 65938 | 41162.11041 | 147428.9744 | -40328.86402 | 39097 | 76688.00002 | -57908.11039 | 62679.86404 | -40328.86402 | 27496 | 915292 | 562142 | 353150 | 62679.86404 | -40328.86402 | 760338 | -150061.578 | -87738 | -10330.422 | 290011 | -4201 | -37680 | 17674323.9 | 61417.578 | 123257 | 13153 | -136410 | 974991 | -974991 | 809949 | 1739236.338 | 472953 | 105039 | -1739236.338 | 351295.338 | -1134965 | -624988 | 1759953 | 1141864 | -1141864 | 577420 | 137587 | 260051.338 | -1394854 | -17624 | 437419.662 | 3627481 | 3002493 | -2139242 | -1479185 | -123786 | -48995 | 788715 | 4511468.474 | 0.0683731 | 0.034447758 | 0.045706963 | 0.038541667 | 71.08346246 | 77.16398444 | 0.046 | 0.363007967 | 0.394170122 | 92.12 | 90.4 | 1.471 | 103.3 | 107.93314 | 76410 | 122.7666667 | 83.27 | 103.6 | 122.8 | 88.16565515 | 0.013490381 | 25.85048895 | -0.007159599 | 0.035895437 | 0.014155582 | -0.12509637 | 0.07668692 | 0.193339839 | 0.468726653 | 0.024712593 | 0.035509737 | 0.024010671 | 0.305681114 | 23039.1 | 24703.4 |

| 2009 | 953184 | 307703 | 326155 | 353292 | 363078 | 1577256 | 410194.439 | 100175.4502 | 99915 | 590431 | 45050 | 29728.59587 | 92382.19295 | -17603.59708 | 17698 | 66364.99993 | -29036.59594 | 35993.59701 | -17603.59708 | 20623 | 1017050 | 564863 | 452187 | 35993.59701 | -17603.59708 | 905176 | -20882.158 | 47923 | -17766.842 | 65986 | -11416 | -63844 | 17578903.82 | 99844.158 | 129192 | 11664 | -140856 | 994220 | -994220 | 779292 | 1839080.496 | 609381 | 119299 | -1839080.496 | 331108.496 | -1146281 | -654677 | 1800958 | 997363 | -997363 | 709095 | 148886 | 242284.496 | -1485583 | -38854 | 424171.504 | 3609162 | 2954485 | -1994758 | -1596796 | -57800 | -60411 | 755280 | 4611643.924 | 0.047566667 | 0.015439495 | 0.038157551 | 0.012291667 | 69.6378712 | 74.34701087 | 0.046 | 0.342015998 | 0.366467855 | 93.666 | 91.1 | 1.395 | 105.1 | 109.31352 | 52081.4 | 88.21666667 | 84.81 | 94.6 | 88.2 | 90.05561801 | 0.01173181 | 26.06828437 | -0.137279696 | 0.022204622 | -0.036907271 | -0.061394253 | 0.05870559 | 0.114059272 | 0.494685006 | 0.008425195 | 0.007743363 | 0.016782458 | -0.281428184 | 22649.4 | 24556 |

| 2010 | 978454 | 331599 | 331166 | 404013 | 433952 | 1611280 | 421807.5657 | 119463.3795 | 107096 | 599034 | 34172 | 26394.39438 | 59409.22375 | 1157.170637 | 10465 | 66268.00032 | -14186.39406 | 21515.82969 | 1157.170637 | 19888 | 1013316 | 613378 | 399938 | 21515.82969 | 1157.170637 | 880005 | -73383.264 | 11535 | 71182.264 | 4682 | -22786 | 8770 | 18852954.48 | 81565.264 | 133437 | 11172 | -144609 | 988877 | -988877 | 732051 | 1920645.76 | 638344 | 151353 | -1920645.76 | 398897.76 | -1154988 | -686301 | 1841289 | 915991 | -915991 | 771981 | 144560 | 313466.76 | -1555046 | -89941 | 414979.24 | 3542337 | 2856036 | -1926419 | -1607179 | -53118 | -83197 | 813877 | 4731107.304 | 0.040316667 | 0.0090607 | 0.036033224 | 0.01 | 71.70039693 | 76.21620721 | 0.046 | 0.340571434 | 0.366240927 | 94.075 | 92.6 | 1.326 | 101 | 104.33731 | 66130.02 | 105.6083333 | 94.19 | 99.5 | 105.6 | 91.06593797 | 0.011297664 | 26.65643189 | 0.077659301 | 0.025904728 | 0.021571641 | -0.023280007 | 0.060064904 | 0.076234869 | 0.614999754 | 0.022561804 | 0.016465423 | 0.004366579 | 0.197147175 | 22472.4 | 24528.1 |

| 2011 | 1007661 | 337468 | 326718 | 443061 | 466151 | 1648757 | 454145.6216 | 119837.064 | 110671 | 608088 | 38915 | 31564.12683 | 66948.11742 | 3531.009403 | 12701 | 73204 | -20791.12682 | 19942.9906 | 3531.009403 | 23516 | 1174074 | 792739 | 381335 | 19942.9906 | 3531.009403 | 917706 | -198504.369 | 146106 | 105275.369 | 111366 | -12726 | -151517 | 18926146.73 | 52916.369 | 141838 | 11535 | -153373 | 984230 | -984230 | 743323 | 1973562.129 | 523412 | 176406 | -1973562.129 | 530421.129 | -1175094 | -704239 | 1879333 | 844950 | -844950 | 755979 | 137492 | 418742.129 | -1371802 | -118956 | 178544.871 | 3470320 | 2766081 | -1882552 | -1554820 | 58248 | -95923 | 708966 | 4850944.368 | 0.045991667 | 0.010808497 | 0.038114264 | 0.0125 | 73.13020337 | 76.50643222 | 0.046 | 0.339883716 | 0.365296473 | 95.587 | 95.3 | 1.392 | 101.6 | 104.48254 | 76271.13 | 133.8916667 | 103.32 | 107.7 | 133.9 | 92.94986771 | 0.011719822 | 26.97159078 | 0.017699088 | 0.025329602 | 0.023259148 | -0.032570412 | 0.058952449 | 0.091452805 | 0.865444093 | 0.011822996 | 0.029157667 | 0.016072283 | 0.267813462 | 22545.5 | 24606.8 |

| 2012 | 995710 | 288966 | 321754 | 460981 | 443052 | 1624359 | 436848.3013 | 65822.55909 | 120511 | 600264 | 37724 | 36778.88178 | 69509.18801 | 4993.693761 | 12686 | 80829.00101 | -16705.88076 | 27765.30725 | 4993.693761 | 23032 | 1032254 | 808402 | 223852 | 27765.30725 | 4993.693761 | 1280778 | 122959.994 | 20845 | -161315.994 | -83650 | -3494 | 104655 | 20616647.33 | 81252.006 | 137756 | 13380 | -151136 | 1046373 | -1046373 | 736578 | 2054814.135 | 746424 | 192181 | -2054814.135 | 379631.135 | -1161701 | -697100 | 1858801 | 912080 | -912080 | 915462 | 126115 | 257426.135 | -1597634 | -140462 | 439092.865 | 3748249 | 3051149 | -1947666 | -1797388 | -25402 | -99417 | 818724 | 4916766.927 | 0.052225 | 0.010920194 | 0.040955894 | 0.00875 | 72.15909697 | 74.3402396 | 0.046 | 0.330371365 | 0.351000189 | 97.066 | 98.4 | 1.285 | 99 | 102.51107 | 83664.24 | 150.1916667 | 108.71 | 111 | 150.2 | 93.74142715 | 0.012787027 | 26.66560051 | -0.143723257 | 0.01356902 | -0.014797814 | -0.031917267 | 0.043422101 | 0.093511418 | 0.95674537 | -0.01134491 | 0.032528856 | 0.015472815 | 0.121740213 | 22510.8 | 25201.8 |

| 2013 | 982190 | 272433 | 319441 | 461783 | 423095 | 1612752 | 455823.3594 | 46261.72137 | 131490 | 594339 | 37854 | 35859.98583 | 85903.61056 | -12189.62473 | 11661 | 74784.99964 | -23152.9862 | 36557.62437 | -12189.62473 | 24224 | 910531 | 727101 | 183430 | 36557.62437 | -12189.62473 | 1111389 | 39870.735 | -96221 | -5962.735 | -118788 | 30741 | 150360 | 20727022.91 | 82082.265 | 139992 | 13043 | -153035 | 1076752 | -1076752 | 643794 | 2136896.4 | 965725 | 187388 | -2136896.4 | 339989.4 | -1106952 | -684676 | 1791628 | 1036255 | -1036255 | 968231 | 106538 | 251463.4 | -1837834 | -103029 | 614630.6 | 3865024 | 3180348 | -2036669 | -1885433 | -144190 | -68676 | 954620 | 4963028.648 | 0.051441667 | 0.010534332 | 0.036395019 | 0.005416667 | 72.85619418 | 74.20675716 | 0.046 | 0.324953192 | 0.343826695 | 98.18 | 99.7 | 1.328 | 101.7 | 104.41029 | 72200.4 | 141.8083333 | 108.7 | 108.3 | 141.8 | 95.63143633 | 0.012113281 | 26.8493095 | -0.057214344 | 0.009408972 | -0.007145588 | -0.031018545 | 0.063809308 | 0.116625273 | 0.797189939 | 0.006889362 | 0.013211382 | 0.011476727 | -0.055817567 | 22136.1 | 25204.8 |

| 2014 | 986310 | 275995 | 317979 | 473719 | 426597 | 1627406 | 487469.4046 | 47695.68219 | 142072 | 595991 | 35086 | 33320.89867 | 91045.6278 | -22638.72913 | 8050 | 71390.99944 | -21486.89923 | 42522.72857 | -22638.72913 | 24471 | 1090953 | 814731 | 276222 | 42522.72857 | -22638.72913 | 1135780 | -7153.324 | 67588 | -144554.676 | -39772 | -9189 | 133081 | 21619705.53 | 66611.324 | 141353 | 12882 | -154235 | 1110770 | -1110770 | 536907 | 2203507.724 | 1273284 | 202850 | -2203507.724 | 190466.724 | -1082212 | -679562 | 1761774 | 1057339 | -1057339 | 1163011 | 103109 | 106908.724 | -2121132 | -126480 | 874583.276 | 4009380 | 3329818 | -2036442 | -2096599 | -183962 | -77865 | 1065050 | 5010724.33 | 0.048666667 | 0.007438469 | 0.033408732 | 0.001583333 | 73.27027149 | 73.95285635 | 0.046 | 0.324784581 | 0.343716797 | 99.077 | 99.9 | 1.329 | 103.4 | 104.6746 | 51756.01 | 130.5583333 | 101.85 | 104.9 | 130.6 | 97.87056077 | 0.01159736 | 26.83314574 | 0.013074774 | 0.009610197 | 0.009086332 | -0.022249501 | 0.071975773 | 0.141420435 | 0.786226363 | -0.000602018 | 0.002006018 | 0.00913628 | -0.079332432 | 22211 | 25447 |

| 2015 | 1005936 | 283186 | 316344 | 491905 | 442016 | 1655355 | 506679.773 | 52692.68081 | 141366 | 609506 | 28901 | 28060.81389 | 76995.17867 | -20033.36478 | 5335 | 65123.99918 | -13475.8147 | 39953.36396 | -20033.36478 | 21638 | 928480 | 694646 | 233834 | 39953.36396 | -20033.36478 | 1134133 | 126440.409 | -112034 | -22738.409 | 9458 | 951 | -2077 | 25354512.33 | 36187.591 | 144595 | 11845 | -156440 | 1137500 | -1137500 | 420995 | 2239695.315 | 1361780 | 289731 | -2239695.315 | 167189.315 | -1059755 | -679918 | 1739673 | 1154348 | -1154348 | 1280495 | 128309 | 84170.315 | -2150302 | -210205 | 867532.685 | 4137933 | 3458015 | -2085794 | -2155525 | -174504 | -76914 | 1034722 | 5063417.011 | 0.0412925 | 0.005034182 | 0.029554695 | 0.0005 | 73.91660601 | 73.91660601 | 0.046 | 0.326924485 | 0.346291842 | 100 | 100 | 1.11 | 100 | 100 | 44458.08 | 100.0083333 | 95.9 | 100 | 100 | 100 | 0.010413187 | 27.21628585 | 0.02605482 | 0.010515981 | 0.017173957 | -0.010583511 | 0.113605146 | 0.143405056 | 0.656975672 | 0.014278613 | 0.001001001 | 0.009315987 | -0.233995021 | 22394.9 | 25428.2 |

| 2016 | 1019579 | 297798 | 322650 | 497339 | 441578 | 1695788 | 492490.8411 | 64880.81749 | 145038 | 625000 | 22308 | 23771.06648 | 53680.81605 | -7601.749576 | 5205 | 63428.00057 | 1081.934091 | 37659.75014 | -7601.749576 | 16267 | 1119880 | 752840 | 367040 | 37659.75014 | -7601.749576 | 1023768 | -66586.909 | 54297 | 41327.909 | 150612 | -9643 | -170007 | 25801943.97 | 46226.909 | 150624 | 11441 | -162065 | 1182519 | -1182519 | 363801 | 2285922.224 | 1315743 | 417139 | -2285922.224 | 189239.224 | -1039509 | -686157 | 1725666 | 1126524 | -1126524 | 1324893 | 149481 | 125498.224 | -1894223 | -341631 | 635981.776 | 4148361 | 3462204 | -2016552 | -2160424 | -23892 | -86557 | 825221 | 5128297.829 | 0.034961667 | 0.005007172 | 0.028319924 | 0.0000833 | 74.77711781 | 73.93865348 | 0.046 | 0.330672683 | 0.351058495 | 101.134 | 99.9 | 1.107 | 102.1 | 100.84031 | 36762.5 | 80.675 | 98.35 | 96 | 80.7 | 102.3973588 | 0.009675109 | 27.55987106 | 0.051598596 | 0.012813643 | 0.024425576 | 0.0007945 | 0.097296888 | 0.127509391 | 0.65217768 | 0.012624251 | -0.001 | 0.01134 | -0.193317223 | 22677.9 | 25689.9 |

| 2017 | 1046342 | 313526 | 327002 | 533720 | 483997 | 1736593 | 493832.7575 | 77624.29988 | 142440 | 642230 | 21320 | 20590.42798 | 46722.17343 | -4811.745452 | 3572 | 62428.001 | 8671.573029 | 37645.74646 | -4811.745452 | 11846 | 1006081 | 689357 | 316724 | 37645.74646 | -4811.745452 | 1218330 | 179170.011 | -84710 | 39424.989 | -57156 | 1275 | -78004 | 26323897.53 | 42848.989 | 155752 | 12001 | -167753 | 1206658 | -1206658 | 330574 | 2328771.213 | 1248226 | 523682 | -2328771.213 | 226289.213 | -1009435 | -697152 | 1706587 | 1157381 | -1157381 | 1480979 | 153462 | 164923.213 | -1841204 | -441211 | 483050.787 | 4331344 | 3634192 | -2013354 | -2163848 | -81048 | -85282 | 709340 | 5205922.128 | 0.030008333 | 0.003538613 | 0.027309766 | 0 | 75.6682106 | 74.27991891 | 0.046 | 0.333580287 | 0.354957562 | 101.869 | 101.3 | 1.13 | 103.4 | 101.39634 | 52193.31 | 95.65 | 101.25 | 99.4 | 95.7 | 103.8605307 | 0.009945652 | 27.98375606 | 0.052814324 | 0.015136465 | 0.02406256 | 0.006590628 | 0.062598016 | 0.128427831 | 0.611932813 | 0.015380515 | 0.014014014 | 0.007267586 | 0.18562132 | 22950.1 | 25857 |

| 2018 | 1066167 | 328194 | 334454 | 555394 | 512818 | 1771391 | 480055.6522 | 88721.58209 | 141572 | 665490 | 16570 | 18683.6736 | 29951.57742 | 5302.096182 | 1934 | 61354.9994 | 16425.3258 | 31740.90322 | 5302.096182 | 9676 | 1326322 | 907171 | 419151 | 31740.90322 | 5302.096182 | 863136 | -419352.251 | 222355 | 99226.251 | 220437 | -3082 | -119584 | 26726264.67 | 52023.251 | 162421 | 12232 | -174653 | 1224330 | -1224330 | 313141 | 2380794.464 | 1202244 | 541877 | -2380794.464 | 323532.464 | -1018031 | -711907 | 1729938 | 1075545 | -1075545 | 1367631 | 171179 | 264149.464 | -1580695 | -455588 | 233323.536 | 4143068 | 3431161 | -1922397 | -2116645 | 139389 | -88364 | 556856 | 5294643.711 | 0.0268 | 0.001899746 | 0.026346512 | 0 | 76.53979104 | 74.34151252 | 0.046 | 0.334562833 | 0.356671486 | 102.957 | 102.5 | 1.181 | 106.7 | 103.37155 | 59646.3 | 115.1333333 | 106.79 | 102.4 | 115.1 | 106.2717832 | 0.00999077 | 28.75506624 | 0.046783999 | 0.017042434 | 0.020038086 | 0.013158936 | 0.04275944 | 0.090604758 | 0.783813627 | 0.027562782 | 0.011846002 | 0.010680384 | 0.203694023 | 23143.4 | 25898.9 |

| 2019 | 1074680 | 327703 | 334512 | 567784 | 508031 | 1796648 | 506154.8658 | 84149.38931 | 146882 | 681104 | 14113 | 18527.37968 | 29505.85369 | 3134.525981 | 3429 | 56871.99979 | 12795.62011 | 31617.4738 | 3134.525981 | 11436 | 1082293 | 869739 | 212554 | 31617.4738 | 3134.525981 | 1426904 | 189603.392 | -29822 | -124910.392 | -98786 | -18379 | 82294 | 28774461.9 | 28976.608 | 165890 | 12654 | -178544 | 1286064 | -1286064 | 289695 | 2409771.072 | 1370663 | 573547 | -2409771.072 | 175866.072 | -995791 | -728244 | 1724035 | 1228692 | -1228692 | 1541288 | 186937 | 139239.072 | -1780685 | -501746 | 414966.928 | 4511629 | 3783385 | -2037546 | -2270532 | 40603 | -106743 | 590833 | 5378793.1 | 0.026025 | 0.003443494 | 0.023887824 | 0 | 77.17560137 | 74.26229167 | 0.046 | 0.334024374 | 0.3556951 | 103.923 | 103.2 | 1.12 | 105.8 | 101.08213 | 55150.68 | 108.25 | 107.02 | 101.5 | 108.3 | 108.7763154 | 0.009839324 | 29.25704467 | -0.001496066 | 0.015893305 | 0.014258286 | 0.010643114 | 0.035347303 | 0.094225457 | 0.808649568 | 0.017457043 | 0.006829268 | 0.009382558 | -0.059785755 | 23280 | 25861.5 |

| 2020 | 963726 | 293530 | 343580 | 488941 | 429156 | 1660621 | 428608.9298 | 46105.51741 | 202196 | 642972 | 10558 | 16955.9478 | 19250.6187 | 8263.329099 | 3779 | 54290.99891 | 16112.05111 | 28583.66981 | 8263.329099 | 10665 | 1126688 | 801632 | 325056 | 28583.66981 | 8263.329099 | 1149580 | -107752.74 | 112818 | -91533.26 | 130876 | -14959 | -29449 | 26993213.3 | 163194.74 | 185433 | 11474 | -196907 | 1371058 | -1371058 | 263335 | 2572965.812 | 1443952 | 764972 | -2572965.812 | 100706.812 | -1041503 | -736292 | 1777795 | 1234134 | -1234134 | 1651571 | 269617 | 47705.812 | -1690684 | -689767 | 411557.188 | 4705531 | 3969239 | -2006020 | -2525260 | 171479 | -121702 | 512264 | 5424898.617 | 0.023283333 | 0.00362841 | 0.022529526 | 0 | 72.73822717 | 68.88024466 | 0.046 | 0.306110974 | 0.323621459 | 105.601 | 103 | 1.142 | 108.1 | 101.91719 | 31741.38 | 78.45 | 99.6 | 96.3 | 78.5 | 111.9985301 | 0.00836872 | 28.16334576 | -0.1042804 | 0.008571722 | -0.075711547 | 0.011754933 | 0.060642737 | 0.066451332 | 0.652427134 | -0.037382413 | -0.001937984 | 0.01614657 | -0.275288684 | 22830.1 | 25140.6 |

| 2021 | 1030124 | 357215 | 352718 | 582192 | 540198 | 1782051 | 483365.7672 | 107669.6636 | 188601 | 692915 | 10905 | 14916.66234 | 12622.01724 | 13199.6451 | 2326 | 60678.00031 | 25091.33797 | 29134.35521 | 13199.6451 | 9765 | 1141970.282 | 738858.2821 | 403112 | 29134.35521 | 13199.6451 | 1116373 | -60674.87011 | 55160.28211 | 275576.588 | -151307 | -5171 | -113584 | 29441497.75 | 105431.588 | 200683 | 10817 | -211500 | 1428434 | -1428434 | 233263 | 2678397.4 | 1366294 | 868289 | -2678397.4 | 210551.4 | -871902 | -763488 | 1635390 | 1372850 | -1372850 | 1583746 | 284629 | 323282.4 | -1563895 | -783662 | 155899.6 | 4818976 | 4055488 | -1960123 | -2355115 | 20172 | -126873 | 366451 | 5532568.281 | 0.020259167 | 0.002667731 | 0.023582902 | 0 | 79.33378445 | 74.72335354 | 0.046 | 0.322101944 | 0.344334175 | 106.17 | 105 | 1.183 | 109.3 | 101.53931 | 64858.995 | 112.4833333 | 125.39 | 105 | 85.59190031 | 114.2006256 | 0.007572628 | 30.84736029 | 0.216962491 | 0.019847314 | 0.073123247 | 0.01737685 | 0.096964642 | 0.047931408 | 0.598685623 | 0.095301693 | 0.019417476 | 0.005388207 | 0.433821967 | 22462.7 | 24829.5 |

Alternatively, simply copy and paste the https address into your browser, save the dataset in the chosen folder, and set the directory path accordingly.

The third step is to create a text file (txt) defining model equations. For a comprehensive description of the behavioral assumptions underlying the behavioral equations, please refer to Canelli, Fontana, Realfonzo, and Veronese Passarella (2024).

Note: we place the key behavioral equations at the end of the code. This arrangement is intentional, as, after estimating model coefficients, the related details are to be read in a 'last in, first out' order from the RStudio Console.

S_model.txt="MODEL

COMMENT> FIRMS SECTOR ----------------------------------------------------------

COMMENT> GDP

IDENTITY> y

EQ> y = cons + id + gov + nx

COMMENT> Growth rate of nominal GDP (auxiliary)

IDENTITY> gy

EQ> gy = (y/TSLAG(y,1))-1

COMMENT> Depreciation rate (average value over the period 1996-2019)

IDENTITY> deltak

EQ> deltak = 0.046

COMMENT> Real investment net of capital depreciation

IDENTITY> idR

EQ> idR = exp(LidR)

COMMENT> Nominal investment including capital depreciation

IDENTITY> id

EQ> id = idR*p/100 + deltak*TSLAG(k,1)

COMMENT> Nominal capital stock

IDENTITY> k

EQ> k = TSLAG(k,1)*(1 - deltak) + id

COMMENT> Firms' profit

IDENTITY> ff

EQ> ff = y - intf - wb + opf

COMMENT> Interest payments on loans to firms

IDENTITY> intf

EQ> intf = rl*lf

COMMENT> Interest rate on loans to firms

IDENTITY> rl

EQ> rl = rstar + mul

COMMENT> Firms' undistributed profit

BEHAVIORAL> fuf

TSRANGE 1998 1 2021 1

EQ> fuf = theta*ff

COEFF> theta

STORE> coe(3)

COMMENT> Firms' distributed profit

IDENTITY> fdf

EQ> fdf = ff - fuf

COMMENT> Firms' demand for bank loans

IDENTITY> lf

EQ> lf = TSLAG(lf,1) + id - fuf - (es-TSLAG(es,1)) + (oaf-TSLAG(oaf,1))

COMMENT> Supply of shares

IDENTITY> es

EQ> es = eh

COMMENT> Total wealth accumulated by firms

IDENTITY> vf

EQ> vf = oaf - (lf + es)

COMMENT> HOUSEHOLD SECTOR ------------------------------------------------------

COMMENT> Disposable income

IDENTITY> yd

EQ> yd = wb - tax + tr + inth + fdf + fb + oph

COMMENT> Real consumption

IDENTITY> consR

EQ> consR = exp(LconsR)

COMMENT> Nominal consumption

IDENTITY> cons

EQ> cons = consR*p/100

COMMENT> Net wealth of households

IDENTITY> vh

EQ> vh = TSLAG(vh,1) + yd - cons

COMMENT> Loans to households

BEHAVIORAL> lh

TSRANGE 1998 1 2021 1

EQ> TSDELTALOG(lh,1) = phi1*TSLAG(cons/yd,1)

COEFF> phi1

STORE> coe(6)

COMMENT> Interests paid by households on personal loans

IDENTITY> intlh

EQ> intlh = rlh*TSLAG(lh,1)

COMMENT> Premium on government bills held by households

BEHAVIORAL> mubh

TSRANGE 1998 1 2021 1

EQ> mubh = mubh1*TSLAG(mubh,1) + mubh2*mub

COEFF> mubh1 mubh2

STORE> coe(7)

COMMENT> Interest rate received households on their government debt holdings

IDENTITY> rbh

EQ> rbh = rstar + mubh

COMMENT> Interests received by households on their government debt holdings

IDENTITY> intgh

EQ> intgh = rbh * TSLAG(bh,1)

COMMENT> Markup on loans to firms

BEHAVIORAL> mul

TSRANGE 1998 1 2021 1

EQ> mul = mul0 + mul1*TSLAG(mub,1)

COEFF> mul0 mul1

STORE> coe(2)

COMMENT> Net interest payments received by households

IDENTITY> inth

EQ> inth = intgh + intmh - intlh

COMMENT> Markup on personal loans to households

BEHAVIORAL> mulh

TSRANGE 1998 1 2021 1

EQ> mulh = mulh0 + mulh1*TSLAG(mub,1)

COEFF> mulh0 mulh1

STORE> coe(7)

COMMENT> Interest rate on loans to households

IDENTITY> rlh

EQ> rlh = rstar + mulh

COMMENT> Wage share (endogenous)

IDENTITY> Omega

EQ> Omega = wb/y

COMMENT> Other assets of households

BEHAVIORAL> oah

TSRANGE 1998 1 2021 1

EQ> oah = oah0 + lambda_oah*TSLAG(oah,1)

COEFF> oah0 lambda_oah

STORE> coe(18)

COMMENT> BANKING SECTOR --------------------------------------------------------

COMMENT> Total supply of loans

IDENTITY> ls

EQ> ls = lf + lh

COMMENT> Supply of bank deposits

IDENTITY> ms

EQ> ms = mh

COMMENT> Banks profit

IDENTITY> fb

EQ> fb = intb

COMMENT> Total interests payments received by banks

IDENTITY> intb

EQ> intb = intgb + intf + intlh - intmh

COMMENT> Net interest payments received by banks on government bills

IDENTITY> intgb

EQ> intgb = rbb*TSLAG(bb,1)

COMMENT> Stock of bills held by banks

BEHAVIORAL> Lbb

TSRANGE 1998 1 2021 1

EQ> Lbb = lambdabb1*TSLAG(log(ls+hbd+bb),1) + lambdabb2*dum

COEFF> lambdabb1 lambdabb2

STORE> coe(33)

COMMENT> bb

IDENTITY> bb

EQ> bb = exp(Lbb)

COMMENT> Total wealth accumulated by banks

IDENTITY> vb

EQ> vb = oab + hbd + bb + ls - ms

COMMENT> GOVERNMENT SECTOR -----------------------------------------------------

COMMENT> Tax revenue

BEHAVIORAL> tax

TSRANGE 1998 1 2021 1

EQ> tax = tau1*(TSLAG(wb,1)) + tau2*(TSLAG((yd - wb),1)) + tau3*(TSLAG(vh,1))

COEFF> tau1 tau2 tau3

STORE> coe(10)

COMMENT> Transfers and benefits

BEHAVIORAL> tr

TSRANGE 1998 1 2021 1

EQ> tr = tau4*TSLAG(tr,1) + tau5*TSDELTA(un,1)

COEFF> tau4 tau5

STORE> coe(11)

COMMENT> Government deficit

IDENTITY> def

EQ> def = gov + tr + intg - tax - fcb

COMMENT> Government debt stock

IDENTITY> deb

EQ> deb = bs

COMMENT> Interest payments on government debt

IDENTITY> intg

EQ> intg = rb*TSLAG(deb,1)

COMMENT> Supply of government bills and bonds

IDENTITY> bs

EQ> bs = TSLAG(bs,1) + def

COMMENT> Net wealth of goverment sector (Note: negative value)

IDENTITY> vg

EQ> vg = - bs + oag

COMMENT> PORTFOLIO EQUATIONS ---------------------------------------------------

COMMENT> Holdings of government bills (log)

BEHAVIORAL> Lbh

TSRANGE 1998 1 2021 1

EQ> Lbh = lambda20*TSLAG(log(vh),1) + lambda21*dum

COEFF> lambda20 lambda21

STORE> coe(16)

COMMENT> Holdings of shares (log)

BEHAVIORAL> Leh

TSRANGE 1998 1 2021 1

EQ> Leh = lambda10*TSLAG(log(vh),1)

COEFF> lambda10

STORE> coe(15)

COMMENT> Holding of shares

IDENTITY> eh

EQ> eh = exp(Leh)

COMMENT> Holding of government bills

IDENTITY> bh

EQ> bh = exp(Lbh)

COMMENT> Holdings of cash (log)

BEHAVIORAL> Lhh

TSRANGE 1998 1 2021 1

EQ> TSDELTA(Lhh,1) = lambdac*log(cons/pc)

COEFF> lambdac

STORE> coe(17)

COMMENT> Holding of cash

IDENTITY> hh

EQ> hh = exp(Lhh)

COMMENT> Holdings of deposits

IDENTITY> mh

EQ> mh = vh + lh - hh - bh - eh - oah

COMMENT> CENTRAL BANK ----------------------------------------------------------

COMMENT> CB holdings of government bills

IDENTITY> bcb

EQ> bcb = bs - bh - bb - brow

COMMENT> Supply of cash

IDENTITY> hs

EQ> hs = bcb + oacb - vcb

COMMENT> Profit realised and distributed by CB

IDENTITY> fcb

EQ> fcb = intg - intgh - intgb - introw

COMMENT> Reserve requirement: demand

IDENTITY> hbd

EQ> hbd = rho*ms

COMMENT> Reserve ratio

BEHAVIORAL> rho

TSRANGE 1998 1 2021 1

EQ> rho = rho_1*TSLAG(rho,1)

COEFF> rho_1

STORE> coe(56)

COMMENT> Total demand for cash and reserves (auxiliary)

IDENTITY> hd

EQ> hd = hbd + hh

COMMENT> FOREIGN SECTOR --------------------------------------------------------

COMMENT> Nominal import

IDENTITY> im

EQ> im = exp(LimR) * p / 100

COMMENT> Nominal export

IDENTITY> x

EQ> x = exp(LxR) * p / 100

COMMENT> Foreign income. Note: yf1 = (1 + gF)

BEHAVIORAL> yf

TSRANGE 1998 1 2021 1

EQ> yf = yf1*TSLAG(yf,1)

COEFF> yf1

STORE> coe(22)

COMMENT> Net export (trade balance)

IDENTITY> nx

EQ> nx = x - im

COMMENT> Stock of Italian bills debt held by foreign agents

IDENTITY> brow

EQ> brow = lambdarow*bs

COMMENT> Total wealth accumulated by RoW

IDENTITY> vrow

EQ> vrow = brow + oarow

COMMENT> Net interest payments received by RoW on government bills

IDENTITY> introw

EQ> introw = rbrow * TSLAG(brow,1)

COMMENT> Exchange rate: dollars per 1 euro

BEHAVIORAL> exr

TSRANGE 1998 1 2021 1

EQ> exr = exr1*MOVAVG(exr,2)

COEFF> exr1

STORE> coe(58)

COMMENT> Share of government bills purchased by foreign agents

BEHAVIORAL> lambdarow

TSRANGE 1998 1 2021 1

EQ> lambdarow = lambdarow1*TSLAG(lambdarow,1) + lambdarow2*TSLAG(rbrow,1)

COEFF> lambdarow1 lambdarow2

STORE> coe(31)

COMMENT> INTEREST RATES --------------------------------------------------------

COMMENT> Return rate on shares

IDENTITY> re

EQ> re = fdf/TSLAG(eh,1)

COMMENT> Policy rate

BEHAVIORAL> rstar

TSRANGE 1998 1 2021 1

EQ> rstar = r0

COEFF> r0

STORE> coe(25)

COMMENT> Average risk premium on government bond

IDENTITY> rb

EQ> rb = rstar + mub

COMMENT> Interest rate received by banks on their government debt holdings

IDENTITY> rbb

EQ> rbb = rstar + mubb

COMMENT> Interest rate received by RoW on their government debt holdings

IDENTITY> rbrow

EQ> rbrow = rstar + mubrow

COMMENT> Premium on government bills held by banks

BEHAVIORAL> mubb

TSRANGE 1998 1 2021 1

EQ> mubb = mubb1*TSLAG(mubb,1) + mubb2*mub

COEFF> mubb1 mubb2

STORE> coe(45)

COMMENT> Premium on government bills held by RoW

BEHAVIORAL> mubrow

TSRANGE 1998 1 2021 1

EQ> mubrow = mubrow1*TSLAG(mubrow,1) + mubrow2*mub

COEFF> mubrow1 mubrow2

STORE> coe(46)

COMMENT> Interests paid by banks to households on deposits and other A/L

BEHAVIORAL> intmh

TSRANGE 1998 1 2021 1

EQ> intmh = intmh0 + intmh1*mh

COEFF> intmh0 intmh1

STORE> coe(47)

COMMENT> LABOUR MARKET ---------------------------------------------------------

COMMENT> Wage bill

IDENTITY> wb

EQ> wb = w*nd

COMMENT> Labour productivity (real value added per employee)

BEHAVIORAL> prod

EQ> TSDELTALOG(prod,1) = nu0 + nu1 * TSDELTALOG(100*w/p,1) + nu2 * TSDELTALOG(100*y/p,2)

COEFF> nu0 nu1 nu2

STORE> coe(51)

COMMENT> Employment: demand for labour

IDENTITY> nd

EQ> nd = (100*y)/(prod*p)

COMMENT> Labour force (log)

BEHAVIORAL> Lns

TSRANGE 1998 1 2021 1

EQ> Lns = nu1*TSLAG(Lns,1) + nu2*( log(nd) -TSLAG(Lns,1))

COEFF> nu1 nu2

STORE> coe(27)

COMMENT> Labour force

IDENTITY> ns

EQ> ns = exp(Lns)

COMMENT> Wage rate growth

BEHAVIORAL> gw

TSRANGE 1998 1 2021 1

EQ> gw = omega1*TSDELTAP(p/100,1) + omega2*TSDELTA(un,1)

COEFF> omega1 omega2

STORE> coe(28)

COMMENT> Nominal wage rate

IDENTITY> w

EQ> w = TSLAG(w,1)*(1+gw)

COMMENT> Unemployment rate

IDENTITY> un

EQ> un = 1-(nd/ns)

COMMENT> PRODUCTION AND PRICES -------------------------------------------------

COMMENT> Price level (GDP deflator)

IDENTITY> p

EQ> p = exp(Lp)

COMMENT> Consumer price index

IDENTITY> pc

EQ> pc = exp(Lpc)

COMMENT> Log foreign price level --- exogenous

BEHAVIORAL> Lp_row

TSRANGE 1998 1 2021 1

EQ> Lp_row = prow0 + prow1*TSLAG(Lp_row,1)

COEFF> prow0 prow1

STORE> coe(60)

COMMENT> Foreign price level

IDENTITY> p_row

EQ> p_row = exp(Lp_row)

COMMENT> Price of import

IDENTITY> p_im

EQ> p_im = exp(Lp_im)

COMMENT> Inflation rate based on GDP deflator

IDENTITY> infl

EQ> infl = (p - TSLAG(p,1))/TSLAG(p,1)

COMMENT> Inflation rate based on CPI

IDENTITY> inflc

EQ> inflc = (pc - TSLAG(pc,1))/TSLAG(pc,1)

COMMENT> Deficit to GDP ratio

IDENTITY> def_ratio

EQ> def_ratio = def/y

COMMENT> Debt to GDP ratio

IDENTITY> deb_ratio

EQ> deb_ratio = deb/y

COMMENT> ENERGY IMPORT ---------------------------------------------------------

COMMENT> Energy Price level

IDENTITY> p_en

EQ> p_en = exp(Lp_en)

COMMENT> Share of energy products to total import

BEHAVIORAL> perc_en

TSRANGE 1998 1 2021 1

EQ> perc_en = enm1*infl_en + enm2*TSLAG(log(y/p),1)

COEFF> enm1 enm2

STORE> coe(54)

COMMENT> Import of energy products

IDENTITY> im_en

EQ> im_en = im * perc_en

COMMENT> Energy inflation rate. Note: high values, so do not use dlog

IDENTITY> infl_en

EQ> infl_en = (p_en - TSLAG(p_en,1))/TSLAG(p_en,1)

COMMENT> Log of energy price --- exogenous

BEHAVIORAL> Lp_en

TSRANGE 1998 1 2021 1

EQ> Lp_en = ep1*TSLAG(Lp_en,1)

COEFF> ep1

STORE> coe(53)

COMMENT> OTHER ACCOUNTING-CONSISTENCY EQUATIONS --------------------------------

COMMENT> Other payments or receipts received by firms

IDENTITY> opf

EQ> opf = vf - TSLAG(vf,1) - (cons + gov + nx - wb - intf - fdf)

COMMENT> Other payments or receipts received by banks

IDENTITY> opb

EQ> opb = fb - intb + (vb - tslag(vb,1))

COMMENT> Other payments or receipts by government

IDENTITY> opg

EQ> opg = vg - TSLAG(vg,1) - ( -gov + tax - tr - intg + fcb)

COMMENT> Other payments or receipts received by CB

IDENTITY> opcb

EQ> opcb = vcb - TSLAG(vcb,1)

COMMENT> Other payments or receipts received by RoW

IDENTITY> oprow

EQ> oprow = -(oph + opf + opg + opb + opcb)

COMMENT> Other payments or receipts of households

BEHAVIORAL> oph

TSRANGE 1998 1 2021 1

EQ> TSDELTAP(oph,1) = par_oph * TSDELTAP(oph,1)

COEFF> par_oph

STORE> coe(57)

COMMENT> Other financial assets held by RoW

IDENTITY> oarow

EQ> oarow = - (oah + oaf + oab + oacb + oag)

COMMENT> Total wealth accumulated by central bank

IDENTITY> vcb

EQ> vcb = -(vh + vf + vrow + vg + vb)

COMMENT> Other financial assets/liabilities of firms

BEHAVIORAL> oaf

TSRANGE 1998 1 2021 1

EQ> oaf = oaf0 + lambda_oaf*TSLAG(oaf,1)

COEFF> oaf0 lambda_oaf

STORE> coe(38)

COMMENT> Other financial assets/liabilities of government

BEHAVIORAL> oag

TSRANGE 1998 1 2021 1

EQ> oag = oag0 + lambda_oag*TSLAG(oag,1)

COEFF> oag0 lambda_oag

STORE> coe(44)

COMMENT> Other financial assets held by banks

BEHAVIORAL> oab

TSRANGE 1998 1 2021 1

EQ> oab = oab0 + lambda_oab*TSLAG(oab,1)

COEFF> oab0 lambda_oab

STORE> coe(52)

COMMENT> Other financial assets held by ECB

BEHAVIORAL> oacb

TSRANGE 1998 1 2021 1

EQ> oacb = oacb0 + lambda_oacb*TSLAG(oacb,1)

COEFF> oacb0 lambda_oacb

STORE> coe(55)

COMMENT> ADDITIONAL CALCULATIONS --------------------------------

COMMENT> Real GDP

IDENTITY> yR

EQ> yR = 100*y/p

COMMENT> Real investment including depreciation (note: iddR > idR)

IDENTITY> iddR

EQ> iddR = 100*id/p

COMMENT> Real export

IDENTITY> xR

EQ> xR = 100*x/p

COMMENT> Real investment including depreciation (note: different from idR)

IDENTITY> imR

EQ> imR = 100*im/p

COMMENT> KEY BEHAVIOURAL EQUATIONS --------------------------------

COMMENT> Real consumption (log). Note: yd replaced with y because the latter is more stable over time

BEHAVIORAL> LconsR

TSRANGE 1998 1 2021 1

EQ> LconsR = alpha1*TSLAG(log(y*100/pc),1) + alpha2*TSLAG( log(vh*100/pc),1)

COEFF> alpha1 alpha2

STORE> coe(5)

COMMENT> Government consumption

BEHAVIORAL> gov

TSRANGE 1998 1 2021 1

EQ> gov = sigma1*TSLAG((gov/p),1)*p

COEFF> sigma1

RESTRICT> sigma1 = 1.01

STORE> coe(12)

COMMENT> Real investment net of capital depreciation

BEHAVIORAL> LidR

TSRANGE 1998 1 2021 1

EQ> LidR = gamma0 + gamma1*TSLAG(log(y)/log(k),1)

COEFF> gamma0 gamma1

STORE> coe(1)

COMMENT> Log of real export

BEHAVIORAL> LxR

TSRANGE 1998 1 2021 1

EQ> LxR = x0 + x1*TSLAG(log(yf),1) + x2*TSLAG(exr*p/p_row,1)

COEFF> x0 x1 x2

STORE> coe(21)

COMMENT> Log of real import

BEHAVIORAL> LimR

TSRANGE 1998 1 2021 1

EQ> LimR = m0 + m1*TSLAG(log(y),1) + m2*TSLAG(p_im/p,1)

COEFF> m0 m1 m2

STORE> coe(20)

COMMENT> Log of price of import

BEHAVIORAL> Lp_im

TSRANGE 1998 1 2021 1

EQ> Lp_im = pim0 + pim1*TSLAG(exr,1) + pim2*TSLAG(Lp_row,1)

COEFF> pim0 pim1 pim2

STORE> coe(59)

COMMENT> Log of price level (GDP deflator)

BEHAVIORAL> Lp

TSRANGE 1998 1 2021 1

EQ> Lp = viy1*TSLAG(Lp_en,1) + viy2*TSLAG(Lp_row,1) + viy3*TSLAG(log(100*y/p),1)

COEFF> viy1 viy2 viy3

STORE> coe(30)

COMMENT> Log of consumer price index

BEHAVIORAL> Lpc

TSRANGE 1998 1 2021 1

EQ> Lpc = vic1*TSLAG(Lp_en,1) + vic2*TSLAG(Lp_row,1) + vic3*TSLAG(log(100*y/p),1)

COEFF> vic1 vic2 vic3

STORE> coe(30)

COMMENT> Average premium on government bills

BEHAVIORAL> mub

TSRANGE 1998 1 2021 1

EQ> mub = mub2*TSLAG(deb/y,1) + mub3*bcb/bs + mub4*rstar

COEFF> mub2 mub3 mub4

STORE> coe(39)

END"

Notice that the two price equations have been defined including real GDP among the deflators. This choice is due to four reasons:

-

Income effect. Real GDP can be considered a proxy for the overall volume of activity or income in an economy. Changes in income can affect the demand for goods and services, thus indirectly affecting the price level.

-

Aggregate demand effect. Real GDP reflects the aggregate demand. When aggregate demand increases, it can put direct upward pressure on prices, particularly when supply is constrained (as it happened in recent years). Therefore, including real GDP in the price equation allows capturing this demand-pressure effect.

-

Macroeconomic and labour market conditions. Real GDP can be taken as a key indicator of the overall health of the economy, hence labour market conditions. A higher employment rate and a lower unemployment rate are usually associated with higher nominal wages. Real GDP serves as a summary measure of these macroeconomic and labour market conditions.

-

Medium-term trend. Real GDP can also be used to capture medium-term trend in the economy, which can in turn influence the price level.

An alternative specification of these equations, including the unit labour cost among the regressors (instead of real GDP), could be:

COMMENT> Log of price level (GDP deflator)

BEHAVIORAL> Lp

TSRANGE 1998 1 2021 1

EQ> TSDELTA(Lp,1) = viy1*TSDELTA(Lp_en,1) + viy2*TSDELTA(Lp_row,1) + viy3*TSDELTA(log(w),1) + viy4*TSDELTA(log(prod),1)

COEFF> viy1 viy2 viy3 viy4

STORE> coe(30)

COMMENT> Log of consumer price index

BEHAVIORAL> Lpc

TSRANGE 1998 1 2021 1

EQ> TSDELTA(Lpc,1) = vic1*TSDELTA(Lp_en,1) + vic2*TSDELTA(Lp_row,1) + vic3*TSDELTA(log(w),1) + vic4*TSDELTA(log(prod),1)

COEFF> vic1 vic2 vic3 vic4

STORE> coe(30)While our qualitative results would not be affected, and the coefficients exhibit the correct signs, the latter are barely significant. This may be attributed to the specific situation of the Italian labour market, where workers have lost most of their bargaining power, while the goods market is characterised by an oligopolistic structure. This is why we pragmatically opted for real GDP in the final specification of the model.

Having clarified that, the fourth step is to load the model.

#Load the model

S_model=LOAD_MODEL(modelText = S_model.txt)This allows displaying the structure of the model (including the number of behavioural equations, identities, and coefficients) in the Console.

Analyzing behaviorals...

Analyzing identities...

Optimizing...

Loaded model "S_model.txt":

40 behaviorals

81 identities

77 coefficients

...LOAD MODEL OKThe fifth step is to associate the model with the imported data. Note: a time series is required for each variable defined in the model, including dummies.

#Attribute values to model variables and coefficients

S_modelData=list(

pc = TIMESERIES(c(DataEE$Pc),

START=c(1995,1),FREQ=1),

Lpc = TIMESERIES(c(log(DataEE$Pc)),

START=c(1995,1),FREQ=1),

gid = TIMESERIES(c(DataEE$gid),

START=c(1995,1),FREQ=1),

gidR = TIMESERIES(c(DataEE$gid-DataEE$PI),

START=c(1995,1),FREQ=1),

infl = TIMESERIES(c(DataEE$PI),

START=c(1995,1),FREQ=1),

inflc = TIMESERIES(c(DataEE$CPI),

START=c(1995,1),FREQ=1),

Lp = TIMESERIES(c(log(DataEE$Py)),

START=c(1995,1),FREQ=1),

p_en = TIMESERIES(c(DataEE$Pen2 ),

START=c(1995,1),FREQ=1),

Lp_en = TIMESERIES(c(log(DataEE$Pen2)),

START=c(1995,1),FREQ=1),

infl_en = TIMESERIES(c(DataEE$PIen),

START=c(1995,1),FREQ=1),

im_en = TIMESERIES(c(DataEE$IMen),

START=c(1995,1),FREQ=1),

perc_en = TIMESERIES(c(DataEE$IMen/DataEE$IM),

START=c(1995,1),FREQ=1),

Lim_en = TIMESERIES(c(log(DataEE$IMen)),

START=c(1995,1),FREQ=1),

y = TIMESERIES(c(DataEE$Y),

START=c(1995,1),FREQ=1),

gy = TIMESERIES(c(DataEE$gy),

START=c(1995,1),FREQ=1),

cons = TIMESERIES(c(DataEE$CONS),

START=c(1995,1),FREQ=1),

id = TIMESERIES(c(DataEE$INV),

START=c(1995,1),FREQ=1),

gov = TIMESERIES(c(DataEE$GOV),

START=c(1995,1),FREQ=1),

x = TIMESERIES(c(DataEE$X),

START=c(1995,1),FREQ=1),

im = TIMESERIES(c(DataEE$IM),

START=c(1995,1),FREQ=1),

Lx = TIMESERIES(c(log(DataEE$X)),

START=c(1995,1),FREQ=1),

Lim = TIMESERIES(c(log(DataEE$IM)),

START=c(1995,1),FREQ=1),

LxR = TIMESERIES(c(log(100*DataEE$X/DataEE$Py)),

START=c(1995,1),FREQ=1),

LimR = TIMESERIES(c(log(100*DataEE$IM/DataEE$Py)),

START=c(1995,1),FREQ=1),

consR = TIMESERIES(c(DataEE$CONS*100/DataEE$Py),

START=c(1995,1),FREQ=1),

LconsR = TIMESERIES(c(log(DataEE$CONS*100/DataEE$Py)),

START=c(1995,1),FREQ=1),

idR = TIMESERIES(c(DataEE$INVnet*100/DataEE$Py),

START=c(1995,1),FREQ=1),

LidR = TIMESERIES(c(log(DataEE$INVnet*100/DataEE$Py)),

START=c(1995,1),FREQ=1),

nx = TIMESERIES(c(DataEE$X-DataEE$IM),

START=c(1995,1),FREQ=1),

wb = TIMESERIES(c(DataEE$WB),

START=c(1995,1),FREQ=1),

yd = TIMESERIES(c(DataEE$YD),

START=c(1995,1),FREQ=1),

vh = TIMESERIES(c(DataEE$NVh),

START=c(1995,1),FREQ=1),

k = TIMESERIES(c(DataEE$K),

START=c(1995,1),FREQ=1),

deltak = TIMESERIES(c(DataEE$Delta ),

START=c(1995,1),FREQ=1),

intf = TIMESERIES(c(DataEE$INTf),

START=c(1995,1),FREQ=1),

lf = TIMESERIES(c(-DataEE$Lf),

START=c(1995,1),FREQ=1),

fdf = TIMESERIES(c(DataEE$DIV),

START=c(1995,1),FREQ=1),

ff = TIMESERIES(c(DataEE$Ff),

START=c(1995,1),FREQ=1),

fuf = TIMESERIES(c(DataEE$FUf),

START=c(1995,1),FREQ=1),

es = TIMESERIES(c(-DataEE$Es),

START=c(1995,1),FREQ=1),

eh = TIMESERIES(c(DataEE$Eh),

START=c(1995,1),FREQ=1),

Leh = TIMESERIES(c(log(DataEE$Eh)),

START=c(1995,1),FREQ=1),

tax = TIMESERIES(c(DataEE$TAX),

START=c(1995,1),FREQ=1),

tr = TIMESERIES(c(DataEE$TR),

START=c(1995,1),FREQ=1),

Ltax = TIMESERIES(c(log(DataEE$TAX)),

START=c(1995,1),FREQ=1),

Ltr = TIMESERIES(c(log(DataEE$TR)),

START=c(1995,1),FREQ=1),

lh = TIMESERIES(c(-DataEE$Lh),

START=c(1995,1),FREQ=1),

ls = TIMESERIES(c(DataEE$Ls),

START=c(1995,1),FREQ=1),

mh = TIMESERIES(c(DataEE$Mh),

START=c(1995,1),FREQ=1),

ms = TIMESERIES(c(-DataEE$Ms),

START=c(1995,1),FREQ=1),

inth = TIMESERIES(c(DataEE$INTh),

START=c(1995,1),FREQ=1),

un = TIMESERIES(c( (DataEE$Ns-DataEE$Nd)/DataEE$Ns ),

START=c(1995,1),FREQ=1),

Omega = TIMESERIES(c(DataEE$WB/DataEE$Y),

START=c(1995,1),FREQ=1),

ns = TIMESERIES(c(DataEE$Ns),

START=c(1995,1),FREQ=1),

Lns = TIMESERIES(c(log(DataEE$Ns)),

START=c(1995,1),FREQ=1),

bs = TIMESERIES(c(-DataEE$Bs),

START=c(1995,1),FREQ=1),

bh = TIMESERIES(c(DataEE$Bh),

START=c(1995,1),FREQ=1),

Lbh = TIMESERIES(c(log(DataEE$Bh)),

START=c(1995,1),FREQ=1),

rbb = TIMESERIES(c(DataEE$Rbb ),

START=c(1995,1),FREQ=1),

mubb = TIMESERIES(c(DataEE$Rbb-DataEE$Rstar),

START=c(1995,1),FREQ=1),

rbrow = TIMESERIES(c(DataEE$Rbrow ),

START=c(1995,1),FREQ=1),

mubrow = TIMESERIES(c(DataEE$Rbrow-DataEE$Rstar),

START=c(1995,1),FREQ=1),

rbh = TIMESERIES(c(DataEE$Rbh ),

START=c(1995,1),FREQ=1),

mubh = TIMESERIES(c(DataEE$Rbh-DataEE$Rstar),

START=c(1995,1),FREQ=1),

introw = TIMESERIES(c(DataEE$INTrow ),

START=c(1995,1),FREQ=1),

fcb = TIMESERIES(c(DataEE$Fcb),

START=c(1995,1),FREQ=1),

re = TIMESERIES(c(DataEE$Re),

START=c(1995,1),FREQ=1),

hh = TIMESERIES(c(DataEE$Hh),

START=c(1995,1),FREQ=1),

Lhh = TIMESERIES(c(log(DataEE$Hh)),

START=c(1995,1),FREQ=1),

rho = TIMESERIES(c(DataEE$RHO),

START=c(1995,1),FREQ=1),

yf = TIMESERIES(c(DataEE$Yrow/1000),

START=c(1995,1),FREQ=1),

rstar = TIMESERIES(c(DataEE$Rstar),

START=c(1995,1),FREQ=1),

mub = TIMESERIES(c(DataEE$Rb-DataEE$Rstar),

START=c(1995,1),FREQ=1),

deb = TIMESERIES(c(DataEE$Deb),

START=c(1995,1),FREQ=1),

vg = TIMESERIES(c(DataEE$Vg),

START=c(1995,1),FREQ=1),

def = TIMESERIES(c(DataEE$DEF1),

START=c(1995,1),FREQ=1),

nd = TIMESERIES(c(DataEE$Nd),

START=c(1995,1),FREQ=1),

ndstar = TIMESERIES(c(DataEE$Y/DataEE$Prod),

START=c(1995,1),FREQ=1),

w = TIMESERIES(c(DataEE$w),

START=c(1995,1),FREQ=1),

gw = TIMESERIES(c(DataEE$gw),

START=c(1995,1),FREQ=1),

bb = TIMESERIES(c(DataEE$Bb),

START=c(1995,1),FREQ=1),

Lbb = TIMESERIES(c(log(DataEE$Bb)),

START=c(1995,1),FREQ=1),

bcb = TIMESERIES(c(DataEE$Bcb),

START=c(1995,1),FREQ=1),

bb_not = TIMESERIES(c(-DataEE$Ms - DataEE$Ls - DataEE$Hbd),

START=c(1995,1),FREQ=1),

hbd = TIMESERIES(c(DataEE$Hbd),

START=c(1995,1),FREQ=1),

hs = TIMESERIES(c(-DataEE$Hs ),

START=c(1995,1),FREQ=1),

hd = TIMESERIES(c(-DataEE$Hs),

START=c(1995,1),FREQ=1),

fb = TIMESERIES(c(DataEE$Fb ),

START=c(1995,1),FREQ=1),

lambdacb = TIMESERIES(c(-DataEE$Bcb/DataEE$Bs),

START=c(1995,1),FREQ=1),

lambdarow = TIMESERIES(c(-DataEE$Brow/DataEE$Bs),

START=c(1995,1),FREQ=1),

oph = TIMESERIES(c(DataEE$OPh),

START=c(1995,1),FREQ=1),

opb = TIMESERIES(c(DataEE$OPb),

START=c(1995,1),FREQ=1),

opcb = TIMESERIES(c(DataEE$OPcb),

START=c(1995,1),FREQ=1),

opf = TIMESERIES(c(DataEE$OPf),

START=c(1995,1),FREQ=1),

opg = TIMESERIES(c(DataEE$OPg),

START=c(1995,1),FREQ=1),

vf = TIMESERIES(c(DataEE$Vf),

START=c(1995,1),FREQ=1),

oprow = TIMESERIES(c(DataEE$OProw),

START=c(1995,1),FREQ=1),

vb = TIMESERIES(c(DataEE$Vb),

START=c(1995,1),FREQ=1),

vrow = TIMESERIES(c(DataEE$Vrow),

START=c(1995,1),FREQ=1),

oah = TIMESERIES(c(DataEE$OAh),

START=c(1995,1),FREQ=1),

Loah = TIMESERIES(c(log(DataEE$OAh)),

START=c(1995,1),FREQ=1),

oaf = TIMESERIES(c(DataEE$OAf),

START=c(1995,1),FREQ=1),

oab = TIMESERIES(c(DataEE$OAb),

START=c(1995,1),FREQ=1),

oag = TIMESERIES(c(DataEE$OAg),

START=c(1995,1),FREQ=1),

oacb = TIMESERIES(c(DataEE$OAcb),

START=c(1995,1),FREQ=1),

oarow = TIMESERIES(c(DataEE$OArow),

START=c(1995,1),FREQ=1),

vcb = TIMESERIES(c(DataEE$Vcb),

START=c(1995,1),FREQ=1),

p = TIMESERIES(c(DataEE$Py),

START=c(1995,1),FREQ=1),

prod = TIMESERIES(c(DataEE$ProdR),

START=c(1995,1),FREQ=1),

rl = TIMESERIES(c(DataEE$Rl ),

START=c(1995,1),FREQ=1),

mul = TIMESERIES(c(DataEE$Rl - DataEE$Rstar ),

START=c(1995,1),FREQ=1),

intgb = TIMESERIES(c(DataEE$INTgb),

START=c(1995,1),FREQ=1),

intgh = TIMESERIES(c(DataEE$INTgh ),

START=c(1995,1),FREQ=1),

intb = TIMESERIES(c(DataEE$INTb),

START=c(1995,1),FREQ=1),

intmh = TIMESERIES(c(DataEE$INTm ),

START=c(1995,1),FREQ=1),

intlh = TIMESERIES(c(DataEE$INTlh ),

START=c(1995,1),FREQ=1),

rlh = TIMESERIES(c(DataEE$Rlh ),

START=c(1995,1),FREQ=1),

mulh = TIMESERIES(c(DataEE$Rlh - DataEE$Rstar ),

START=c(1995,1),FREQ=1),

rb = TIMESERIES(c(DataEE$Rb),

START=c(1995,1),FREQ=1),

mub = TIMESERIES(c(DataEE$Rb-DataEE$Rstar),

START=c(1995,1),FREQ=1),

intg = TIMESERIES(c(DataEE$INTg),

START=c(1995,1),FREQ=1),

brow = TIMESERIES(c(DataEE$Brow),

START=c(1995,1),FREQ=1),

pc = TIMESERIES(c(DataEE$Pc),

START=c(1995,1),FREQ=1),

exr = TIMESERIES(c(DataEE$Exr),

START=c(1995,1),FREQ=1),

exr42 = TIMESERIES(c(DataEE$Exr42 ),

START=c(1995,1),FREQ=1),

exr42 = TIMESERIES(c(DataEE$Exr42 ),

START=c(1995,1),FREQ=1),

dum = TIMESERIES(c(0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,1,1,1,1,1,1,1,1,1),

START=c(1995,1),FREQ=1),

p_im = TIMESERIES(c(DataEE$Pim ),

START=c(1995,1),FREQ=1),

Lp_im = TIMESERIES(c(log(DataEE$Pim)),

START=c(1995,1),FREQ=1),

p_im_en = TIMESERIES(c(DataEE$Pim_en ),

START=c(1995,1),FREQ=1),

Lp_im_en = TIMESERIES(c(log(DataEE$Pim_en)),

START=c(1995,1),FREQ=1),

p_row = TIMESERIES(c(DataEE$Py_row ),

START=c(1995,1),FREQ=1),

Lp_row = TIMESERIES(c(log(DataEE$Py_row)),

START=c(1995,1),FREQ=1),

yR = TIMESERIES(c(DataEE$Y*100/DataEE$Py),

START=c(1995,1),FREQ=1),

iddR = TIMESERIES(c(DataEE$INV*100/DataEE$Py),

START=c(1995,1),FREQ=1),

xR = TIMESERIES(c(DataEE$X*100/DataEE$Py),

START=c(1995,1),FREQ=1),

imR = TIMESERIES(c(DataEE$IM*100/DataEE$Py),

START=c(1995,1),FREQ=1),

def_ratio = TIMESERIES(c(DataEE$DEF1/DataEE$Y),

START=c(1995,1),FREQ=1),

deb_ratio = TIMESERIES(c(DataEE$Deb/DataEE$Y),

START=c(1995,1),FREQ=1)

)

#Load the data into the model

S_model=LOAD_MODEL_DATA(S_model,S_modelData)The sixth step is to estimate model coefficients:

#Estimate model coefficients

S_model=ESTIMATE(S_model

,TSRANGE = c(1998,1,2019,1) #Choose time range for estimations

,forceTSRANGE = TRUE #If TRUE, the TSRANGE above takes precedence over individual equations TSRANGEs

,CHOWTEST = FALSE #If TRUE, performs Chow test: stability analysis (reject H0 of "no structural break")

,CHOWPAR = NULL #If NULL, use last periods

)Now, we can execute the entire code, enabling the creation of the model and the estimation of the associated coefficients. Information on the estimations is displayed in the Console. For instance, the following details pertain to the estimation of the risk premium for government securities (

BEHAVIORAL EQUATION: mub

Estimation Technique: OLS

mub = 0.03222813 TSLAG(deb/y,1)

T-stat. 12.05956 ***

- 0.07942629 bcb/bs

T-stat. -3.732844 **

- 0.4223384 rstar

T-stat. -6.374726 ***

STATs:

R-Squared : 0.9773436

Adjusted R-Squared : 0.9737663

Durbin-Watson Statistic : 0.9611077

Sum of squares of residuals : 0.0002797596

Standard Error of Regression : 0.003837208

Log of the Likelihood Function : 92.7822

F-statistic : 273.2053

F-probability : 8.881784e-16

Akaike's IC : -177.5644

Schwarz's IC : -173.2002

Mean of Dependent Variable : 0.02246469

Number of Observations : 22

Number of Degrees of Freedom : 19

Current Sample (year-period) : 1998-1 / 2019-1

Signif. codes: *** 0.001 ** 0.01 * 0.05

...ESTIMATE OKThe details of the other estimations can be visualised by scrolling up through the Console information. The complete list of estimated coefficients is provided below:

| Name | Description | Value |

|---|---|---|

| Depreciation rate (average 1996-2019) | 0.046 | |

| Share of undistributed profits | 0.265 | |

| Elasticity of personal loans to consumption | 0.058 | |

| Premium on gov. bills held by households: coefficient 1 | 0.793 | |

| Premium on gov. bills held by households: coefficient 2 | 0.804 | |

| Markup on loans to firms: coefficient 1 | -0.014 | |

| Markup on loans to firms: coefficient 2 | 0.49 | |

| Markup on personal loans: coefficient 1 | 0.029 | |

| Markup on personal loans: coefficient 2 | 0.23 | |

| Other financial assets of households: coefficient 1 | 134828.967 | |

| Other financial assets of households: coefficient 2 | 0.908 | |

| Stock of bills held by banks: coefficient 1 | 0.918 | |

| Average tax rate on labour incomes | 0.514 | |

| Average tax rate on non-labour incomes | 0.061 | |

| Average tax rate on wealth | 0.042 | |

| Transfers and benefits: auto-regressive component | 1.043 | |

| Transfers and benefits: elasticity to unemployment rate | 374169.858 | |

| Holdings of government bills: coefficient 1 | 0.903 | |

| Holdings of shares as a ratio to total wealth | 0.925 | |

| Elasticity of cash holdings to real consumption | 0.006 | |

| Reserve ratio | 1.004 | |

| Foreign growth rate | 0.037 | |

| Exchange rate coefficient | 1 | |

| Policy rate | 0.019 | |

| Premium on government bills held by banks: coefficient 1 | 0.924 | |

| Premium on government bills held by banks: coefficient 2 | 0.248 | |

| Premium on government bills held by RoW: coefficient 1 | 0.554 | |

| Premium on government bills held by RoW: coefficient 2 | 0.916 | |

| Labour productivity: autonomous component | -0.004 | |

| Labour productivity: elasticity to real wage rate | 0.397 | |

| Labour productivity: elasticity to real output | 0.183 | |

| Labour force: auto-regressive component | 1.001 | |

| Labour force: elasticity to labour demand gap | 0.031 | |

| Wage growth rate: elasticity to inflation | 0.009 | |

| Wage growth rate: elasticity to unemployment rate | -0.786 | |

| Foreign price level: coefficient 1 | 0.207 | |

| Foreign price level: coefficient 2 | 0.959 | |

| Share of energy prod. to tot. import: elasticity to energy inflation | -0.002 | |

| Share of energy prod. to tot. import: elasticity to real output | 0.013 | |

| Energy price coefficient | 1.006 | |

| Other financial assets/liabilities of firms: coefficient 1 | 16702.341 | |

| Other financial assets/liabilities of firms: coefficient 2 | 0.897 | |

| Other financial assets/liabilities of government: coefficient 1 | 86022.616 | |

| Other financial assets/liabilities of government: coefficient 2 | 0.583 | |

| Other financial assets held by banks: coefficient 1 | -431517.076 | |

| Other financial assets held by banks: coefficient 2 | 0.745 | |

| Other financial assets held by ECB: coefficient 1 | -4533.844 | |

| Other financial assets held by ECB: coefficient 2 | 1.141 | |

| Marginal propensity to consume out of real income | 0.906 | |

| Marginal propensity to consume out of real wealth | 0.055 | |

| Real government spending: auto-regressive coefficient | 1.01 | |

| Real net investment: autonomous component | -117.512 | |

| Real net investment: elasticity to output to capital ratio | 138.616 | |

| Real export: autonomous component | 7.879 | |

| Real export: elasticity to foreign income | 0.512 | |

| Real export: elasticity to relative price of export | 0.08 | |

| Real import: autonomous component | 4.092 | |

| Real import: elasticity to domestic income | 0.633 | |

| Real import: elasticity to relative price of import | -0.106 | |

| GDP deflator: elasticity to energy price level | 0.058 | |

| GDP deflator: elasticity to foreign price level | 0.619 | |

| GDP deflator: elasticity to real output | 0.104 | |

| Consumer price index: elasticity to energy price level | 0.182 | |

| Consumer price index: elasticity to foreign price level | 0.505 | |

| Consumer price index: elasticity to real output | 0.101 | |

| Av. premium on gov. bills: elasticity to debt to GDP ratio | 0.032 | |

| Av. premium on gov. bills: elasticity to ECB’s holdings | -0.079 | |

| Av. premium on gov. bills: elasticity to policy rate | -0.422 |

Note: Simple OLS estimations have been employed. Additionally, log levels (instead of first differences) have been considered. In principle, this may raise concerns, as most variables are non-stationary, thus possibly leading to spurious correlations. The rationale for our choice is that observed annual time series are quite short and affected by structural breaks (such as the launch of the euro, the COVID-19 crisis, etc.). This makes the use of more sophisticated estimation techniques challenging. Furthermore, while the stationarity issue could be addressed by taking first differences, abandoning levels would imply a further loss of information. Lastly, note that the aim of the model is not to outpredict other methods, but to provide a theoretical tool to develop and assess alternative policy scenarios.

As mentioned earlier, the first step in defining the level of aggregation for the model and reclassifying available data is to create the balance sheet and the transactions-flow matrix of the economy. This process can also be used to double-check ex-post model consistency. The following code chunk facilitates the creation of the balance sheet using observed series (in both HTML and LaTeX format):

#Balance-sheet for Italy SFC model

#Observed series

################################################################################

#Choose a year (26=2020)

yr = 27

#Create row names for BS matrix

rownames<-c( "Cash and reserves",

"Deposits",

"Securities",

"Loans",

"Shares",

"Other net FA",

"Net financial wealth",

"Column total")

################################################################################

#Create firms aggregates

Firms <-c( 0,

0,

0,

round(-S_modelData$lf[yr], digits = 0),

round(-S_modelData$es[yr], digits = 0),

round(S_modelData$oaf[yr], digits = 0),

round(S_modelData$vf[yr], digits = 0),

round(-S_modelData$lf[yr]-S_modelData$es[yr]+S_modelData$oaf[yr]-S_modelData$vf[yr], digits = 0)

)

#Create table of results

FirmDataBS<-as.data.frame(Firms,row.names=rownames)

#Print firms column

kable(FirmDataBS)

################################################################################

#Create banks aggregates

Banks <-c( round(S_modelData$hbd[yr], digits = 0),

-round(S_modelData$ms[yr], digits = 0),

round(S_modelData$bb[yr], digits = 0),

round(S_modelData$ls[yr], digits = 0),

0,

round(S_modelData$oab[yr], digits = 0),

round(S_modelData$vb[yr], digits = 0),

round(S_modelData$hbd[yr]-S_modelData$ms[yr]+S_modelData$bb[yr]+S_modelData$ls[yr]+S_modelData$oab[yr]-S_modelData$vb[yr], digits = 0)

)

#Create table of results

BankDataBS<-as.data.frame(Banks,row.names=rownames)

#Print banks column

kable(BankDataBS)

################################################################################

#Create ECB aggregates

ECB <-c( -round(S_modelData$hs[yr], digits = 0),

0,

round(S_modelData$bcb[yr], digits = 0),

0,

0,

round(S_modelData$oacb[yr], digits = 0),

round(S_modelData$vcb[yr], digits = 0),

round(-S_modelData$hs[yr]+S_modelData$bcb[yr]+S_modelData$oacb[yr]-S_modelData$vcb[yr], digits = 0)

)

#Create table of results

ECBDataBS<-as.data.frame(ECB,row.names=rownames)

#Print ECB column

kable(ECBDataBS)

################################################################################

#Create government aggregates

Government <-c(0,

0,

round(-S_modelData$bs[yr], digits = 0),

0,

0,

round(S_modelData$oag[yr], digits = 0),

round(S_modelData$vg[yr], digits = 0),

round(-S_modelData$bs[yr]+S_modelData$oag[yr]-S_modelData$vg[yr], digits = 0)

)

#Create table of results

GovDataBS<-as.data.frame(Government,row.names=rownames)

#Print government column

kable(GovDataBS)

################################################################################

#Create household aggregates

Households <-c(round(S_modelData$hh[yr], digits = 0),

round(S_modelData$mh[yr], digits = 0),

round(S_modelData$bh[yr], digits = 0),

round(-S_modelData$lh[yr], digits = 0),

round(S_modelData$eh[yr], digits = 0),

round(S_modelData$oah[yr], digits = 0),

round(S_modelData$vh[yr], digits = 0),

round(S_modelData$hh[yr]+S_modelData$mh[yr]+S_modelData$bh[yr]-S_modelData$lh[yr]+S_modelData$eh[yr]+S_modelData$oah[yr]-S_modelData$vh[yr], digits = 0)

)

#Create table of results

HouseDataBS<-as.data.frame(Households,row.names=rownames)

#Print households column

kable(HouseDataBS)

################################################################################

#Create foreign sector aggregates

Foreign <-c( 0,

0,

round(S_modelData$brow[yr], digits = 0),

0,

0,

round(S_modelData$oarow[yr], digits = 0),

round(S_modelData$vrow[yr], digits = 0),

round(S_modelData$brow[yr]+S_modelData$oarow[yr]-S_modelData$vrow[yr], digits = 0)

)

#Create table of results

ROWDataBS<-as.data.frame(Foreign,row.names=rownames)

#Print foreign sector column

kable(ROWDataBS)

################################################################################

#Create row total (when entries > 2)

Total <-c( round(S_modelData$hh[yr]+S_modelData$hbd[yr]-S_modelData$hs[yr], digits = 0),

round(S_modelData$mh[yr]-S_modelData$ms[yr], digits = 0),

round(S_modelData$bh[yr]+S_modelData$bb[yr]+S_modelData$bcb[yr]+S_modelData$brow[yr]-S_modelData$bs[yr], digits = 0),

round(-S_modelData$lf[yr]-S_modelData$lh[yr]+S_modelData$ls[yr], digits = 0),

round(S_modelData$eh[yr]-S_modelData$es[yr], digits = 0),

round(S_modelData$oaf[yr]+S_modelData$oab[yr]+S_modelData$oacb[yr]+S_modelData$oag[yr]+S_modelData$oah[yr]+S_modelData$oarow[yr], digits = 0),

round(-(S_modelData$vf[yr]+S_modelData$vb[yr]+S_modelData$vcb[yr]+S_modelData$vg[yr]+S_modelData$vh[yr]+S_modelData$vrow[yr]), digits = 0),

round(S_modelData$hh[yr]+S_modelData$hbd[yr]-S_modelData$hs[yr] +

S_modelData$mh[yr]-S_modelData$ms[yr] +

S_modelData$bh[yr]+S_modelData$bb[yr]+S_modelData$bcb[yr]+S_modelData$brow[yr]-S_modelData$bs[yr] +

-S_modelData$lf[yr]-S_modelData$lh[yr]+S_modelData$ls[yr] +

S_modelData$eh[yr]-S_modelData$es[yr]+

S_modelData$oaf[yr]+S_modelData$oab[yr]+S_modelData$oacb[yr]+S_modelData$oag[yr]+S_modelData$oah[yr]+S_modelData$oarow[yr], digits = 0) )

#Create table of results

TotalDataBS<-as.data.frame(Total,row.names=rownames)

#Print foreign sector column

kable(TotalDataBS)

################################################################################

#Create BS matrix

Italy_BS_Matrix<-cbind(HouseDataBS,FirmDataBS,GovDataBS,BankDataBS,ECBDataBS,ROWDataBS,TotalDataBS)

kable(Italy_BS_Matrix)

################################################################################