-

Notifications

You must be signed in to change notification settings - Fork 1

Commit

This commit does not belong to any branch on this repository, and may belong to a fork outside of the repository.

Showing

27 changed files

with

337 additions

and

15 deletions.

There are no files selected for viewing

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| Original file line number | Diff line number | Diff line change |

|---|---|---|

| @@ -0,0 +1,75 @@ | ||

| name: build | ||

|

|

||

| on: | ||

| push: | ||

| branches: | ||

| - main | ||

| tags: | ||

| - v* | ||

| pull_request: | ||

| branches: | ||

| - main | ||

|

|

||

| permissions: | ||

| contents: write | ||

|

|

||

| env: | ||

| FOUNDRY_PROFILE: ci | ||

|

|

||

| jobs: | ||

| build-foundry: | ||

| name: Foundry project | ||

| strategy: | ||

| matrix: | ||

| platform: [ubuntu-latest] | ||

| runs-on: ${{ matrix.platform }} | ||

| steps: | ||

| - uses: actions/checkout@v4 | ||

| with: | ||

| submodules: recursive | ||

|

|

||

| - name: Install Foundry | ||

| uses: foundry-rs/foundry-toolchain@v1 | ||

| with: | ||

| version: nightly | ||

|

|

||

| - name: Run Forge build | ||

| run: | | ||

| forge --version | ||

| forge build --sizes | ||

| id: build | ||

|

|

||

| - name: Run Forge fmt | ||

| run: | | ||

| forge fmt | ||

| id: fmt | ||

|

|

||

| - name: Run Forge tests | ||

| run: | | ||

| forge test -vvv | ||

| id: test | ||

|

|

||

| - name: Generate Forge snapshot | ||

| run: | | ||

| forge snapshot | ||

| id: snapshot | ||

|

|

||

| - name: Generate a changelog | ||

| uses: orhun/git-cliff-action@v2 | ||

| id: git-cliff | ||

| if: startsWith(github.ref, 'refs/tags/') | ||

| with: | ||

| config: cliff.toml | ||

| args: -vv --latest --strip header | ||

| env: | ||

| OUTPUT: CHANGES.md | ||

|

|

||

| - name: Debug changelog output | ||

| run: echo "${{ steps.git-cliff.outputs.content }}" | ||

| if: startsWith(github.ref, 'refs/tags/') | ||

|

|

||

| - name: Release | ||

| uses: softprops/action-gh-release@v1 | ||

| if: startsWith(github.ref, 'refs/tags/') | ||

| with: | ||

| body: ${{ steps.git-cliff.outputs.content }} |

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| Original file line number | Diff line number | Diff line change |

|---|---|---|

|

|

@@ -8,7 +8,7 @@ out/ | |

| /broadcast/**/dry-run/ | ||

|

|

||

| # Docs | ||

| docs/ | ||

| # docs/ | ||

|

|

||

| # Dotenv file | ||

| .env | ||

|

|

||

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| Original file line number | Diff line number | Diff line change |

|---|---|---|

| @@ -0,0 +1,49 @@ | ||

| # Web3学习之Uniswap V2 的手续费计算 | ||

|

|

||

| ## Uniswap V2 的手续费计算 | ||

|

|

||

| Uniswap协议针对每笔交易收取0.05%的手续费(即0.3%的1/6)。该手续费默认关闭,但是可以在未来被打开,在打开后流动性提供者将只能获取0.25%手续费,而非0.3%,因为其中0.05%分给协议。 | ||

|

|

||

| 也就是说,Uniswap v2 包含 0.05% 的协议费用,可以打开或关闭。如果打开,此费用将发送到工厂合约中指定的 feeTo 地址。 | ||

|

|

||

| 最初,feeTo 未设置,不收取任何费用。通过预先指定的地址——feeToSetter——可以调用 Uniswap v2 工厂合约上的 setFeeTo 函数,将 feeTo 设置为不同的值。feeToSetter 还可以调用 setFeeToSetter 来更改 feeToSetter 地址本身。 | ||

|

|

||

| 如果设置了 feeTo 地址,协议将开始收取 5 个基点的费用,这是流动性提供者赚取的 30 个基点费用的 1/6 倍。也就是说,交易者将继续为所有交易支付 0.30% 的费用;该费用的 83.3%(交易金额的 0.25%)将归于流动性提供者,而该费用的 16.6%(交易金额的 0.05%)将归于 feeTo 地址。 | ||

|

|

||

| 在交易时收取这 0.05% 的费用将对每笔交易产生额外的 gas 成本。为了避免这种情况,只有在存入或提取流动性时才会收取累积费用。合约计算累积费用,并在任何代币被铸造或销毁之前立即向费用受益人铸造新的流动性代币。 | ||

|

|

||

| <https://github.com/Fankouzu/my-uniswap-v2-core/blob/master/WhitepaperCN.pdf> | ||

|

|

||

| <https://uniswap.org/whitepaper.pdf> | ||

|

|

||

|  | ||

|

|

||

| ### Uniswap V2 的手续费计算过程 | ||

|

|

||

| #### 第一种情况 | ||

|

|

||

|  | ||

|

|

||

| #### 公式推导 | ||

|

|

||

|  | ||

|

|

||

| #### 第二种情况 | ||

|

|

||

|  | ||

|

|

||

| 第三种情况(实际使用的) | ||

|

|

||

|  | ||

|

|

||

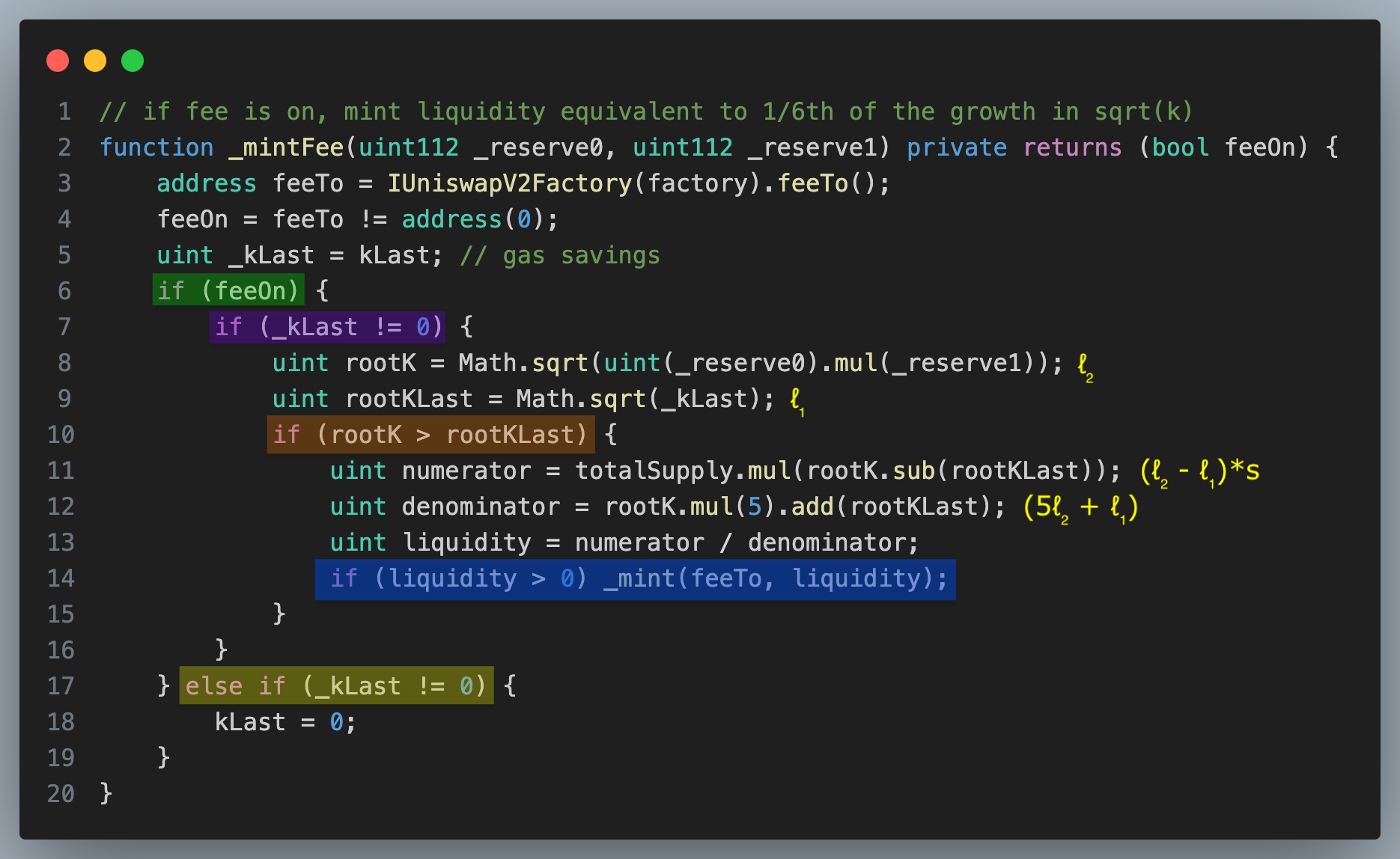

| ## 代码中的实现 | ||

|

|

||

| <https://github.com/Uniswap/v2-core/blob/master/contracts/UniswapV2Pair.sol> | ||

|

|

||

|  | ||

|

|

||

| <https://www.rareskills.io/post/uniswap-v2-mintfee> | ||

|

|

||

| <https://static.wixstatic.com/media/935a00_dc3d8ea8db88403aadba4d2ee1c48d05~mv2.png> | ||

|

|

||

|  |

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| Original file line number | Diff line number | Diff line change |

|---|---|---|

| @@ -0,0 +1,200 @@ | ||

| # Web3学习之去中心化交易所(DEX) | ||

|

|

||

| ## 去中心化交易所(DEX) | ||

|

|

||

| 稳定币、交易所、借贷是DeFi 领域的三大支柱 | ||

|

|

||

| ### 交易所 | ||

|

|

||

| - 证券交易所 | ||

| - 期货交易所 | ||

| - 加密资产交易所 | ||

| - 中心化交易所 | ||

| - 去中心化交易所 | ||

|

|

||

| 区块链中的交易所指的是加密资产交易所 | ||

|

|

||

| 中心化交易所排名 | ||

|

|

||

| #### Top加密货币现货交易所 | ||

|

|

||

| <https://coinmarketcap.com/rankings/exchanges/> | ||

|

|

||

|  | ||

|

|

||

| #### Top加密货币去中心化交易所 | ||

|

|

||

| <https://coinmarketcap.com/rankings/exchanges/dex/?type=spot> | ||

|

|

||

|  | ||

|

|

||

| #### 最热门的加密货币 | ||

|

|

||

| - <https://coinmarketcap.com/trending-cryptocurrencies/> | ||

|

|

||

|  | ||

|

|

||

| ### 中心化交易所的业务模式——以币安为例 | ||

|

|

||

| - 交易费:交易所通过提供买卖加密货币的平台来收取交易费用。有些交易所还提供高级交易选项,如杠杆交易,这通常会带来更高的费用 | ||

| - 上币费:项目方团队后面都会去找交易所上币,但是上币是需要缴纳一笔数额不小的上币费 | ||

| - 量化交易:用户在交易所中,一般数字资产币都是暂时存放在交易所,基本上交易所掌握所有筹码可以选择做多或者做空,交易所可以去赚取差价,而且用户提币出去也可以赚取手续费 | ||

| - 原生代币 | ||

|

|

||

| #### 火币出售 | ||

|

|

||

| 李林 孙宇晨 | ||

|

|

||

| 币安 赵长鹏 何一 | ||

|

|

||

| ### 中心化交易所的交易模式——订单簿模式 | ||

|

|

||

| - 中央限价订单簿(CLOB)就是一本由出价和报价组成的权限透明账本,从最好价开始依次排序(两边分别是参与者愿意买/卖的价格) | ||

| - 所有的参与者都能看到所有的报价和出价,他们也可以参与其中 | ||

| - 订单簿中两边的第一行,即是最好的报价/出价 | ||

|

|

||

|  | ||

|

|

||

| ### 订单簿模式的优劣 | ||

|

|

||

| #### 优势 | ||

|

|

||

| - 透明的流动性 | ||

| - 做市商可自由出入 | ||

| - 做市商可以自由决定价格与数量 | ||

|

|

||

| #### 劣势 | ||

|

|

||

| - 冷启动问题(很难给出初始流动性) | ||

| - 对非流动性资产不利 | ||

| - 如果是链上交易所,则对链的TPS要求很高 | ||

|

|

||

| ### 中心化交易所的风险:FTX 崩盘始末 | ||

|

|

||

| 中心化交易所(CEX)虽然提供了便捷的加密货币交易服务,但也面临许多风险,FTX 交易所的崩盘事件是这些风险的一个典型例子。以下是关于中心化交易所的风险以及 FTX 崩盘始末的详细解释。 | ||

|

|

||

| #### 中心化交易所的风险 | ||

|

|

||

| 1. **托管风险**:用户的资产由交易所托管,交易所持有用户的私钥,这意味着如果交易所被黑客攻击或内部管理不善,用户的资产可能面临损失。 | ||

|

|

||

| 2. **操作风险**:交易所可能因为内部操作失误、管理不善或道德风险导致用户资产损失。 | ||

|

|

||

| 3. **流动性风险**:如果交易所缺乏足够的流动性,用户可能无法及时交易,或者在市场波动时难以迅速反应。 | ||

|

|

||

| 4. **合规风险**:中心化交易所需要遵守各国的法律法规。若交易所未能合规,可能面临罚款、资产冻结甚至关闭。 | ||

|

|

||

| 5. **透明度问题**:中心化交易所的运营和财务情况往往不透明,用户难以了解其实际运营状况。 | ||

|

|

||

| #### FTX 崩盘始末 | ||

|

|

||

| FTX 是一家知名的加密货币交易所,由 Sam Bankman-Fried 创建,于 2022 年因一系列事件导致崩盘。以下是这一事件的关键点: | ||

|

|

||

| 1. **快速崛起**:FTX 迅速成长为全球领先的加密货币交易所之一,提供广泛的交易产品和服务,并受到广泛认可。 | ||

|

|

||

| 2. **财务问题**:2022 年初,有传闻指出 FTX 及其关联公司 Alameda Research 存在严重的财务问题和管理不善。随后,FTX 的财务状况成为市场关注的焦点。 | ||

|

|

||

| 3. **用户恐慌**:随着财务问题的传闻扩散,用户开始担心其在 FTX 上的资产安全,导致大量用户提款。FTX 面临流动性危机,无法满足用户的提款需求。 | ||

|

|

||

| 4. **内部挪用**:进一步的调查揭示,FTX 和 Alameda Research 之间存在不透明的资金转移,涉及用户资金的挪用,进一步加剧了市场对 FTX 的信任危机。 | ||

|

|

||

| 5. **交易所崩盘**:随着提款压力增加,FTX 最终无法维持运营,于 2022 年 11 月申请破产。数十亿美元的用户资产被冻结,导致大量用户蒙受损失。 | ||

|

|

||

| 6. **法律后果**:FTX 的崩盘引发了全球范围内的法律和监管调查,其创始人 Sam Bankman-Fried 及其他高管面临法律诉讼和刑事指控。 | ||

|

|

||

| #### 教训与反思 | ||

|

|

||

| 1. **加强监管**:FTX 崩盘事件表明,加密货币市场需要更严格的监管措施,确保交易所的财务透明度和用户资产的安全。 | ||

|

|

||

| 2. **分散风险**:用户应避免将所有资产存放在单一交易所,采用多种存储方式(如冷钱包和多家交易所)分散风险。 | ||

|

|

||

| 3. **尽职调查**:在选择交易所时,用户应进行尽职调查,选择具有良好信誉和透明度的交易所。 | ||

|

|

||

| 4. **提高警惕**:用户应时刻关注市场动态和交易所的运营情况,及时应对潜在风险。 | ||

|

|

||

| FTX 事件提醒我们,在享受加密货币交易便捷性的同时,必须高度重视风险管理和资产安全。 | ||

|

|

||

| ### 链上交易方案:自动做市商 | ||

|

|

||

| 去中心化交易所一般不会选择使用订单簿的模式,因为订单簿的模式对链上的TPS要求太高。 | ||

|

|

||

| - 出现原因:以太坊的TPS 对于支撑链上订单簿的实时更新来说太低了。反面案例:Solana 链由于其 60K 的TPS,所以上面有很多订单簿模式的交易所。 | ||

| - 交易所里没有订单簿,只有一系列预设的函数,为各类货币的互相交换来定价。 | ||

| - 这些预设的函数(例如 `x * y = k`)基于两头货币在各自流动性池中的供给变化率,来设定价格。在某个货币的流动性池内,任何人都能够提供该种货币以增加其流动性,从而获得收益。 | ||

|

|

||

| ### CPAMM:Constant Product Auto Market Maker | ||

|

|

||

| - 基础公式:`x * y = k` | ||

| - `Liquidity Provider(LP) 与 Liquidity Provider Token(LPT)` | ||

| - LPT 数量 `s = sqrt(x * y)` | ||

|

|

||

| - 初始流动性确定价格 | ||

|

|

||

| 只要有价差,就一定会有套利空间,有套利空间的话,一定会被机器人吃掉。 | ||

|

|

||

| 做区块链项目一定不要一厢情愿,市场上有无数的机器人,只要有价差,就一定会被套利 | ||

|

|

||

| ### Dex 的去中心性 | ||

|

|

||

| - 任何人都可以添加流动性,成为 LP 并拿到 LP Token | ||

| - LP 在任意时间可以移除流动性并销毁LP Token,拿回自己添加的 Token | ||

| - 用户可以使用非官方的前端页面来进行交易 | ||

| - 交易时收取一定手续费,并且分配给 LPT Holder | ||

|

|

||

| ### 自动化做市模式的优劣 | ||

|

|

||

| #### 自动化做市模式的优势 | ||

|

|

||

| - 对于新的代币,可以很方便的冷启动 | ||

| - 去中心化 | ||

| - 代币交换可组合性很高 | ||

|

|

||

| #### 自动化做市模式的劣势 | ||

|

|

||

| - 所有价格点的统一流动性(在 Uniswap V3 中已解决) | ||

| - 滑点频繁 | ||

| - 波动性大,经常有很大的临时亏损(流动性提供者在平均表现上是盈利的) | ||

|

|

||

| ### CPAMM 里的数学 | ||

|

|

||

| 起始状态:`x * y = k` | ||

|

|

||

| - 添加流动性 `Add liquidity` | ||

| - `(x + △x) * (y + △y) = k1` 其中 `△x / △y = x / y,k1 > k` | ||

| - 交易 Swap | ||

| - `(x - △x) * (y + △y) = k` 或 `(x + △x) * (y - △y)` | ||

| - 移除流动性 `Remove liquidity` | ||

| - `(x - △x) * (y - △y) = k2` 其中 `△x / △y = x / y,k2 < k` | ||

|

|

||

| <https://app.uniswap.org/swap?lng=en-US> | ||

|

|

||

| #### Swap | ||

|

|

||

|  | ||

|

|

||

| #### 添加流动性 | ||

|

|

||

|  | ||

|

|

||

| ### CPAMM 公式推导详解 | ||

|

|

||

| #### Swap | ||

|

|

||

| #### 添加流动性、移除流动性 | ||

|

|

||

|  | ||

|

|

||

| #### 计算S | ||

|

|

||

|  | ||

|

|

||

| #### 推导公式一 | ||

|

|

||

|  | ||

|

|

||

| #### 推导公式二 | ||

|

|

||

|  | ||

|

|

||

| #### 滑点 | ||

|

|

||

|  |

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.

Loading

Sorry, something went wrong. Reload?

Sorry, we cannot display this file.

Sorry, this file is invalid so it cannot be displayed.