SDK for creating new strategies on Uniswap V3

git clone https://github.com/mellow-finance/mellow-strategy-sdk.git

cd mellow-strategy-sdk

python3 -m venv .venv

source .venv/bin/activate

pip install poetry

poetry installor

python3 -m venv .venv

source .venv/bin/activate

pip install mellow_strategy_sdkfrom mellow_sdk.primitives import Pool, Token, Fee

from mellow_sdk.data import RawDataUniV3

from mellow_sdk.strategies import UniV3Passive

from mellow_sdk.backtest import Backtest

from mellow_sdk.viewers import RebalanceViewer, UniswapViewer, PortfolioViewer

from mellow_sdk.positions import BiCurrencyPosition, UniV3PositionA typical notebook would start with downloading and preparing data for a specific pool. Let's choose WBTC/WETH, fee 0.3% pool.

pool = Pool(Token.WBTC, Token.WETH, Fee.MIDDLE)Аt the first run you need to download the data

data = RawDataUniV3(pool, 'data', reload_data=False).load_from_folder()univ3_passive = UniV3Passive(

lower_price=data.swaps['price'].min() - 1,

upper_price=data.swaps['price'].max() + 1,

pool=pool,

gas_cost=0.,

name='passive'

)Next step is to run backtest using your strategy and data

bt = Backtest(univ3_passive)

portfolio_history, rebalance_history, uni_history = bt.backtest(data.swaps)Next visualize results

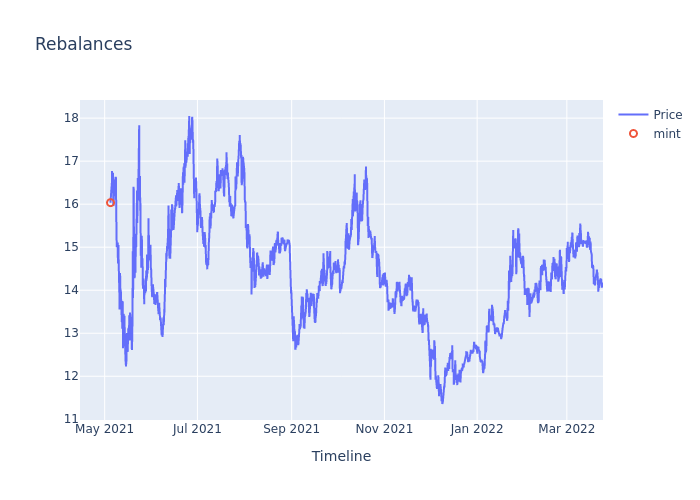

rv = RebalanceViewer(rebalance_history)

uv = UniswapViewer(uni_history)

pv = PortfolioViewer(portfolio_history, pool)

# Draw portfolio stats, like value, fees earned, apy

fig1, fig2, fig3, fig4, fig5, fig6 = pv.draw_portfolio()

# Draw Uniswap intervals

intervals_plot = uv.draw_intervals(data.swaps)

# Draw rebalances

rebalances_plot = rv.draw_rebalances(data.swaps)

# Calculate df with portfolio stats

stats = portfolio_history.calculate_stats()intervals_plot.show()rebalances_plot.show()fig2.show()fig4.show()fig6.show()Congratulations! Now you have the results of your strategy backtest on the real UniV3 data!