-

Notifications

You must be signed in to change notification settings - Fork 8

SEPA Direct Debit

With SEPA Direct Debit Core, creditors may collect payments in EUR both domestically and in other SEPA member countries.

On this page SEPA Direct Debit always refers to SEPA Direct Debit Core.

-

Select Shop Settings/Payment Methods.

-

Scroll down to Wirecard SEPA Direct Debit.

-

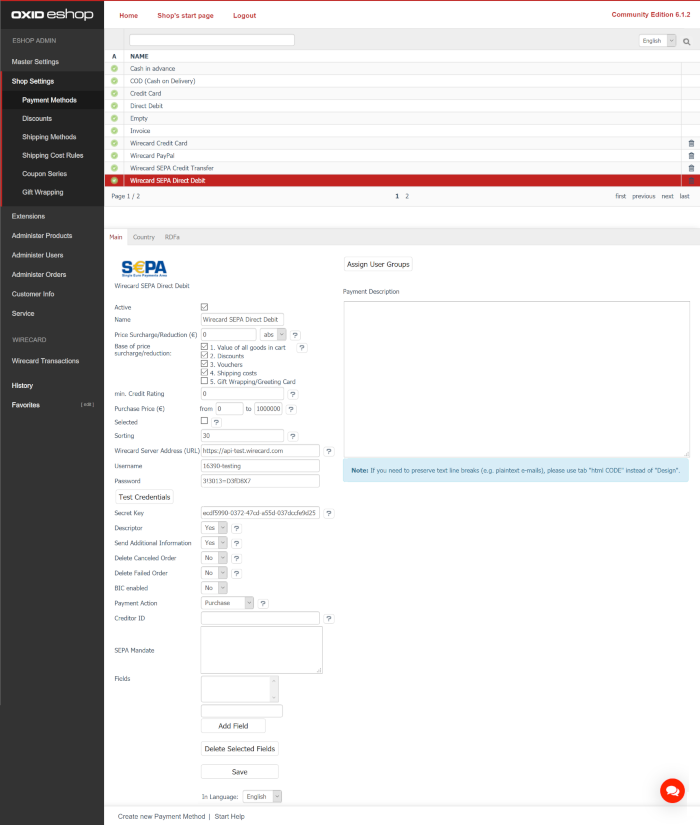

Click Wirecard SEPA Direct Debit to open the SEPA Direct Debit configuration page:

SEPA Direct Debit requires a Creditor ID to create a SEPA Direct Debit Mandate and supports configuration fields for creditor name and creditor city to be displayed in the mandate.

In order to be able to offer SEPA Direct Debit as a payment method, you have to apply for a Creditor Identifier. The Creditor ID is a mandatory identifier for anyone who wants to offer SEPA Direct Debit. It allows consumers to be able to manage their mandates with merchants more easily. SEPA Direct Debit supports configuration for the creditor name and the creditor city to be displayed in the mandate.

This strongly depends on the local rules and regulations. Depending on the country of origin, the merchant may need to apply for the Creditor ID at a tax office, local authority, or another organization.

A German merchant needs to apply for a Creditor ID at the Bundesbank Deutschland. To learn more about how to apply for a Creditor ID, please refer to http://www.bundesbank.de.

An Austrian merchant needs to apply for a Creditor ID at the Österreichische Nationalbank. To learn more about how to apply for a Creditor ID in Austria, refer to www.oenb.at.

Note: The SEPA Mandate field is a multi-language configuration field. For more details on multi-language configuration fields, please see the Configuration page.

During checkout, the consumer can choose SEPA Direct Debit only if the total purchase price is within the specified limits. Select the limits according to your Wirecard contract.

The descriptor is the text representing an order on the consumer's bank statement issued by their bank. It provides information for the consumer, as it associates a specific debit on the consumer's account with the respective purchase in your shop.

-

If the descriptor is set to No, the Provider Transaction Reference ID is provided for the bank statement.

-

If the descriptor is set to Yes, the default descriptor text consists of the first 9 characters of the shop name and the order number. To modify the descriptor, use the method

addDescriptorin the fileExtend/Model/PaymentGateway.php.- Max. total descriptor length: 100 characters

Set this feature to Yes to send the descriptor with each request/response.

If this feature is set to Yes, additional data will be sent for the purpose of fraud protection. This additional data includes billing/shipping address, shopping basket, and descriptor.

Note: The additional information includes the descriptor even if the descriptor option is set to No.

If this feature is set to Yes, every time the payment process is canceled before completion of the authorization/purchase, the corresponding order will be automatically deleted from the OXID order management.

If this feature is set to Yes, every time the payment process fails to complete the authorization/purchase successfully, the corresponding order will be automatically deleted from the OXID order management.

Set this feature to Yes to display an input field for the consumer's BIC during checkout process. In this case, this is a mandatory input field for your consumer.

SEPA Direct Debit payment can be performed with two different payment actions:

1. Authorization: Payments for orders are not captured/invoiced but only authorized by the consumer and thus only reserved. For debit, you have to confirm/capture the amount manually.

-

This payment action triggers the transaction type authorization for payment method SEPA Direct Debit.

-

Authorization is possible through the payment provider services of either Wirecard Bank or Hobex (for Austrian, German and Dutch merchants).

2. Purchase: Payments for orders are captured/invoiced automatically.

- This payment action triggers the transaction type debit for payment method SEPA Direct Debit.

SEPA Direct Debit payments require a notification from SEPA to be completed. Therefore, SEPA Direct Debit payments are marked as Pending for up to two days.

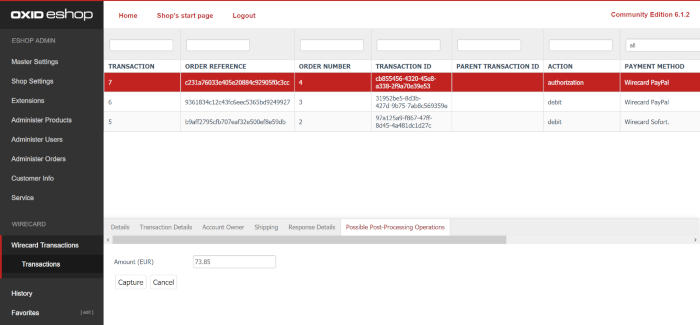

To access post-processing operations, go to Wirecard Transactions to open the transaction table, which lists all successful transactions:

Click a Transaction ID to open the transaction detail view. It shows all available post-processing operations, e.g.:

SEPA Direct Debit requires some time to confirm a transaction. Transactions are only visible in the transaction table if they have been confirmed as successful.

Please note that even when a transaction may have been successfully processed by the consumer's bank, the transaction might still be reversed due to, for example, insufficient funds on the consumer's bank account. Should this be the case, a new transaction using the transaction type debit-return will be created. This transaction will contain a detailed description of what happened.

It should further be noted that a consumer can object to any authorized debit without giving a reason for up to 8 weeks. In this case, a transaction of type debit-return will be created.

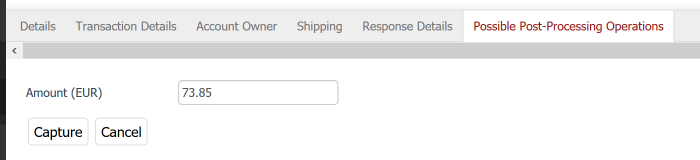

Depending on your Payment Action settings, there are different post-processing operation workflows for SEPA Direct Debit:

1. Capture: Triggers transaction type debit. The payment will be captured/invoiced, and the corresponding order in OXID order management will be updated to status Processing.

2. Refund: Triggers transaction type credit. The payment/invoice will be refunded, and the corresponding order in OXID order management will be updated to status Refunded.

1. Refund: Triggers transaction type credit. The payment/invoice will be refunded, and the corresponding order in OXID order management will be updated to status Refunded.

You also have the option of partial Refund/Capture. Partial Refund/Capture is possible until the payment has been refunded/captured in full.

SEPA Direct Debit supports the post-processing operation Refund via SEPA Credit Transfer. For more details on how to enable and configure refunds for SEPA Direct Debit, please see the SEPA Credit Transfer page.

Please be aware that stock management is not included in the post-processing operations triggered in the Wirecard module but only in OXID order management.

© 2019 Wirecard - Terms of Use - Legal Notice - Wirecard Shop Extensions