| timezone |

|---|

Asia/Shanghai |

请在上边的 timezone 添加你的当地时区,这会有助于你的打卡状态的自动化更新,如果没有添加,默认为北京时间 UTC+8 时区 时区请参考以下列表,请移除 # 以后的内容

timezone: Pacific/Honolulu # 夏威夷-阿留申标准时间 (UTC-10)

timezone: America/Anchorage # 阿拉斯加标准时间 (UTC-9)

timezone: America/Los_Angeles # 太平洋标准时间 (UTC-8)

timezone: America/Denver # 山地标准时间 (UTC-7)

timezone: America/Chicago # 中部标准时间 (UTC-6)

timezone: America/New_York # 东部标准时间 (UTC-5)

timezone: America/Halifax # 大西洋标准时间 (UTC-4)

timezone: America/St_Johns # 纽芬兰标准时间 (UTC-3:30)

timezone: America/Sao_Paulo # 巴西利亚时间 (UTC-3)

timezone: Atlantic/Azores # 亚速尔群岛时间 (UTC-1)

timezone: Europe/London # 格林威治标准时间 (UTC+0)

timezone: Europe/Berlin # 中欧标准时间 (UTC+1)

timezone: Europe/Helsinki # 东欧标准时间 (UTC+2)

timezone: Europe/Moscow # 莫斯科标准时间 (UTC+3)

timezone: Asia/Dubai # 海湾标准时间 (UTC+4)

timezone: Asia/Kolkata # 印度标准时间 (UTC+5:30)

timezone: Asia/Dhaka # 孟加拉国标准时间 (UTC+6)

timezone: Asia/Bangkok # 中南半岛时间 (UTC+7)

timezone: Asia/Shanghai # 中国标准时间 (UTC+8)

timezone: Asia/Tokyo # 日本标准时间 (UTC+9)

timezone: Australia/Sydney # 澳大利亚东部标准时间 (UTC+10)

timezone: Pacific/Auckland # 新西兰标准时间 (UTC+12)

- I'm Breeze, a software development engineer specializing in front-end and script development. I'm continuously exploring Web3 technologies, with a particular interest in DeFi, which is one of the most prominent application areas in the Web3 space. I'm eager to deepen my understanding of DeFi through this learning experience.

- 你认为你会完成本次残酷学习吗?

of course

study the https://banklessdao.substack.com/p/the-stablecoin-edition-defi-download

- Why the World Needs Stablecoins:

- Frictionless Cryptocurrency Trading: Stablecoins eliminate the need to convert cryptocurrency to fiat currency when trading, reducing reliance on traditional banking systems and their associated fees and delays.

- Faster and Cheaper International Remittances: Compared to traditional wire transfers, stablecoins offer significantly lower fees and near-instantaneous transaction speeds, making them ideal for international payments and remittances.

- Enhanced Security and Transparency: Stablecoins leverage blockchain technology, providing greater security against fraud and arbitrary seizures compared to traditional banking systems. Transactions are transparent, cryptographically secured, and require personal accountability, minimizing risks associated with intermediaries.

todo:

- Why did the Luna algorithmic stablecoin collapse?

continue study

Types of Stablecoins

- Fiat-collateralized Stablecoins (USDT, USDC, BUSD, etc.)

- Crypto-backed Stablecoins (DAI, USDP, etc.)

- Commodity-backed Stablecoins (USDC.io, etc.)

- Algorithmic Stablecoins (UST, etc.)

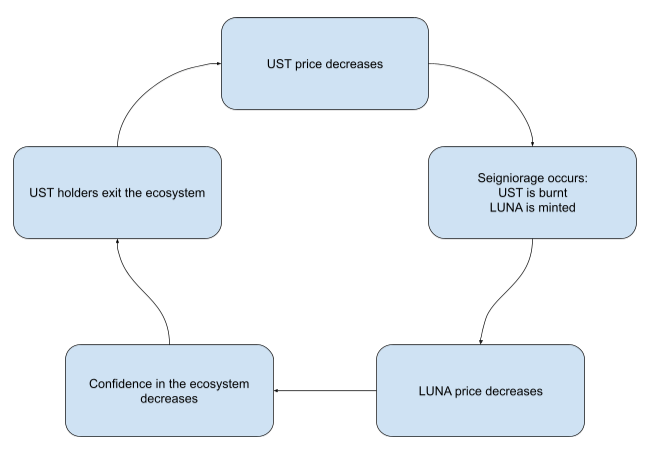

The collapse of the Luna algorithmic stablecoin was due to several interconnected factors:

-

Flawed Design: The Luna/UST system relied on an algorithmic mechanism to maintain UST's peg to the US dollar. This mechanism was based on the ability to swap 1 UST for $1 worth of Luna, which was supposed to create arbitrage opportunities to keep UST at $1. However, this design was vulnerable to extreme market conditions.

-

Bank Run: When large amounts of UST were sold off rapidly, it triggered a "death spiral." As UST's price fell below $1, more people tried to redeem UST for Luna, causing Luna's price to plummet. This further eroded confidence in UST, leading to more sell-offs.

-

Lack of Sufficient Backing: Unlike traditional stablecoins backed by real assets, UST was primarily backed by Luna tokens and some Bitcoin reserves. When the system was stressed, these reserves proved insufficient to maintain the peg.

-

Market Volatility: The crypto market was experiencing a downturn, which added pressure to the already strained system.

-

Loss of Confidence: As the mechanism failed to maintain the peg, users lost confidence in the system, accelerating the collapse.

-

Complexity and Lack of Understanding: Many users may not have fully understood the risks associated with algorithmic stablecoins, leading to panic when the system showed signs of stress.

The Luna collapse highlighted the risks associated with algorithmic stablecoins and the importance of robust backing and risk management in stablecoin designs.

- read the chapter “future of defi” and complete the the-stablecoin-edition-defi-download

- read the https://nigdaemon.gitbook.io/how-to-defi-advanced-zhogn-wen-b/di-6-zhang-qu-zhong-xin-hua-de-wen-ding-bi-he-wen-ding-zi-chan

- study the MakerDAO, and The Maker Protocol Smart Contract Modules System is complicated

- https://drive.google.com/file/d/1VtGV8Ct2iBO8WjWsjFYLg5DnwlGmetSp/view?pli=1

- Vat - The single source of truth for the Maker Protocol.

- Cat - Public interface for confiscating unsafe urns (Vaults) and processing seized collateral

- Spotter - Allows external actors to update the price feed in Vat for a given Ilk

- smart contract https://github.com/makerdao/dss.git;

the maker protocol Design Considerations

- Token Agnostic

- System is indifferent to implementation of external tokens

- The Join adapters abstract away the differences between ERC 20s, Non Fungible Tokens (NFTs), invoice tokens, etc

- Verifiable ○ Designed from bottom up to be well suited for formal verification; every Vat state defined and proved ○ The Vat makes no external calls, as functions in external contracts are subject to change ○ The Vat contains no precision loss; it only adds, subtracts, and multiplies

- Modular and Upgradable ○ Implementations of e.g. auctions, liquidation, Vault risk conditions, and new collateral types, to be altered on a live system through Maker Governance Vault States within the Vat

read the https://web3caff.com/zh/archives/80903 and Centrifuge

-

RWA: Real World Asset Tokenization

-

some project such as Monetalis Clydesdal, use the On-chain governance of MakerDAO + off-chain governance of the foundation system

read the https://mp.weixin.qq.com/s/gzr9q9kM3j-R0ec7sCb3NQ

- paypal publish the pyUsd

- visa

todo:

- We can use ETH to borrow DAI, then purchase US Treasury RWA (Real World Asset), which generally yields an annual return of about 5%. This is higher than the return from staking ETH on Lido. If we adopt this approach, what are the associated risks?

- https://debank.com/profile/0x3e8734ec146c981e3ed1f6b582d447dde701d90c/history