There are 3 main tokens on Babylonia. BABY (BABY), CHIP(CHP) and CREDIT (CRD). BABY is the main token of the platform, hard-capped to 888,888,888, mintable and partially backed by collaterals. CHIP & CREDIT are functional tokens, can be used only in babylonia.app, they are not hard-capped, cannot be minted by public.

Update 06. Sep 2022: Due to the recent decision by founders, we decided to postpone the traditional web2 games & gambling and continue developing only in-house web3 smart contract based games. Therefore, CHIP & CREDIT tokens won't be available.

Update 01. March 2023: We had to hard-fork the $BABY token on BNB chain and pull out of the one-sided farming minting contracts from some DEXes. The new contract is issued and the holders will be air-dropped.

Token format: ERC20 compatible, on Binance Smart Chain (BSC), Polygon & Fantom, the Ethereum, and Avalanche expansions are also on the way. The BABY token will be bridged between the blockchains, maintaining the total hard cap, will be distributed proportionally to the performance & demand of network. As the BSC transaction fee getting more expensive due to increase in price of BNB, we gradually move toward Polygon & Fantom.

CoinGecko: Babylonia

CoinMarketCap: Babylonia

DEX: Pancakeswap

BABY Token (BABY) address: 0xA4E26Bd6DCBa9021DCd3A1159BA52e97CD770b8a

BABY BNB: 0xA4E26Bd6DCBa9021DCd3A1159BA52e97CD770b8a forked to

0xe6dFa7118961851d62297Eb7bBe453364D880Ba5

https://bscscan.com/token/0xe6dFa7118961851d62297Eb7bBe453364D880Ba5?a=0xd81ab8628AE0EE303d317bf7315206e087982f3d

BNBICO1M1: 0xE4CbCD4064B86960719CBF1C0703de3a0DD903F7 --> disabled

BNBICO1M2: 0x84b1ef16C1461B7864a611925FbF31736f924a40 --> disabled

BABY POLYGON: 0xA4E26Bd6DCBa9021DCd3A1159BA52e97CD770b8a

https://polygonscan.com/token/0xa4e26bd6dcba9021dcd3a1159ba52e97cd770b8a

Polygon1CO1M1: 0xe35101eca87FEbD106D45Be43e40b2d1690433D1 --> disabled

PolygonICO1M2: 0x84b1ef16C1461B7864a611925FbF31736f924a40 --> disabled

BABY FANTOM: 0xA4E26Bd6DCBa9021DCd3A1159BA52e97CD770b8a

https://ftmscan.com/token/0xa4e26bd6dcba9021dcd3a1159ba52e97cd770b8a

FantomICO1M1:0xE4CbCD4064B86960719CBF1C0703de3a0DD903F7 --> disabled

FantomICO1M2: 0x84b1ef16C1461B7864a611925FbF31736f924a40 --> disabled

How the system works? Let's dive in!

The BABY token is the native token of the Babylonia.app platform. It is an ERC-20 format token, and it is available on multiple chains such as BNB Chain (BSC), Ethereum, Avalanche (AVAX), Polygon and Fantom. The BABY token protocol is designed to be fully decentralized, using a trading model known as an automated liquidity protocol. The liquidity pool will be introduced in the OPEN MARKET phase of roadmap development.

The Baby token is capped at maximum supply of 888,888,888 BABY. At its core, it uses a mechanism that we called it “Proportionally backed token mechanism (PBTM)”.

In cryptocurrency, collateral tokens are used as a risk mitigation asset when borrowing other types of crypto tokens. Just like with collateral used in traditional finance, collateral tokens serve as a risk-mitigating asset for lenders when borrowers want to get a crypto loan. In BABYLONIA, we use PBTM system. Based on two years of active experience in DeFi sector, we have seen rise and fall of many token values. The DeFi tokens tend to have more expansion rate, as a tool to promote higher yields and APR on the holding, staking and farming products. Consequently, at the short amount of time they reach to their climax and fall down pretty fast and hard, some can never recover. In PBTM system, we have more support and backing for BABY Token, also collaterals will be liquidated to buyback tokens from the market, if the price of token falls in respect with the total cryptocurrency market cap. So, it is a braking system to slow down the downtrends.

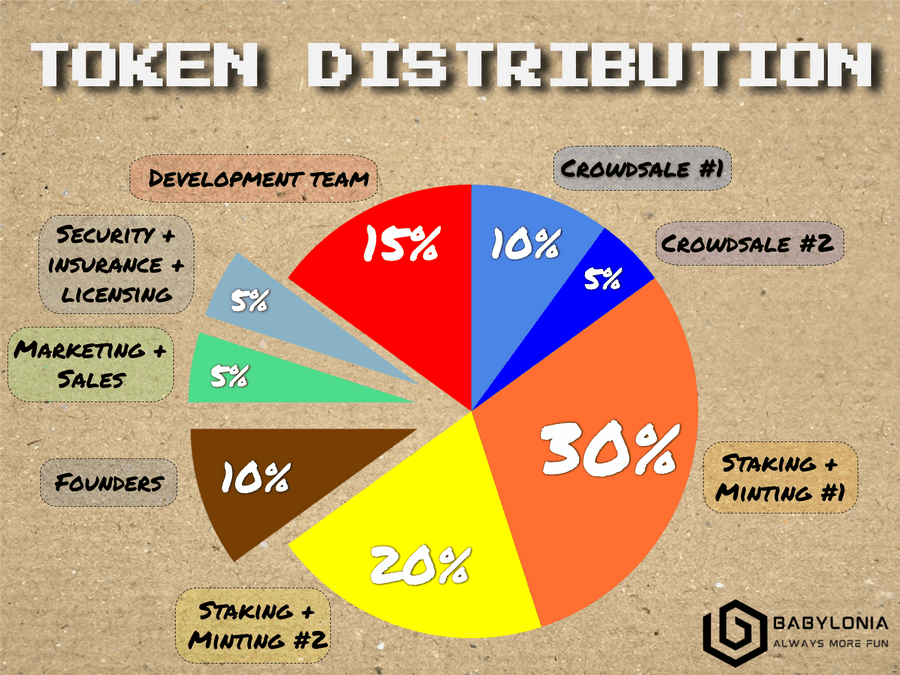

Let's talk about the BABY Token distribution model. We have studied tokenomics of many second layer and DeFi projects, we concluded the release period of 2-3 years for all the 888 m tokens. Forty percent of the token will be assigned to the internal project requirements and 60% will be distributed to the public by Crowdsale events and two years of stacking and yield farming. We are not a believer of timed-locked for liquidity or vested wallets, as we have seen times and times over, frauds find a workaround to scam and dump the projects for profits.

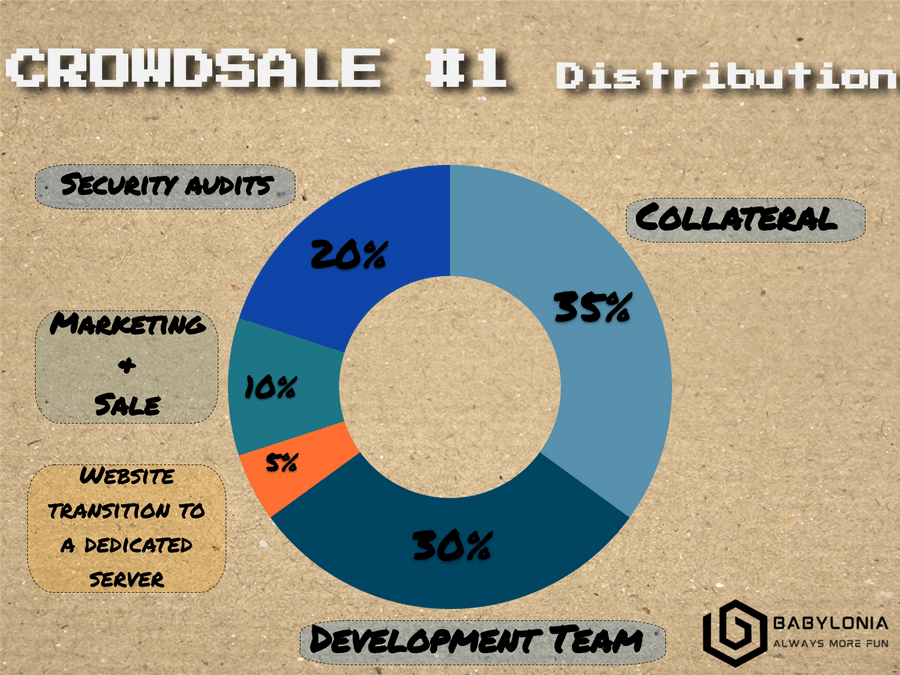

Crowdsale #1: 10% equal to 88,888,888 - SP: $0.01 -->Unsold quantity will be transferred to second pre-sale

The Crowdsale #1 revenue generation will be distributed as: Development Team 35%, Collateral 30%, Website transition to a dedicated server 5%, Security audits 10%, and finally Marketing & Sale 20%.

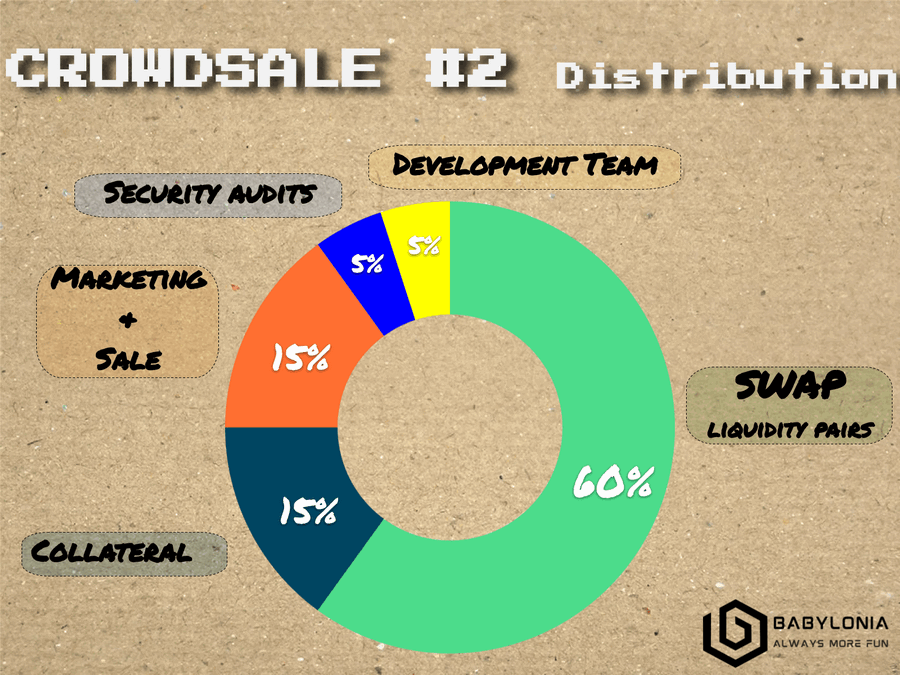

Crowdsale #2: 5% equal to 44,444,444 - SP: $0.02 proportionally -->Unsold pre-sale will be transferred to Open Market Launch.

The revenue generation will be assigned to: SWAP liquidity pairs 60%, Collateral 15%, Marketing & Sale 15%, Security audits 5%, Development Team 5%.

What is remained and left of Crowdsale (unsold tokens) + to yield rewards to the total of 70% of total supply in next two years.

Expansion rate will proportional to the market demand, less demand will reduce the minting rate, higher demand will accelerate the minting ratio. We are still working on the whereabouts of the algorithm but for the first six months, the expansion will be fixed to (100% - 30% + unsold tokens from crowd sales %) / 2 years, so if all 20% of tokens which are assigned to the crowd sales have been sold, the targeted expansion rate will be 50% in 2 years, or 2.088% monthly.

Let's talk about the rest 30% of BABY tokens. 10% is designated to the founders, will be unlocked a year after the main launch. Other 7% goes to the marketing and sales activities. 5% is for the licensing, insurance and security audits. And finally, 11% is assigned to the development and team buybacks, burning and backing Aside from creating an entertaining platform that everyone have fun and spend a good time, the main goal of babylonia.app is to reward tokens holders, as the most important part of this platform. Without support of citizens of babylonia.app we never could develop the platform as effectively. So, embedded into the system, every dollar of income of the platform is being shared with PBTM tokens holders. The accurate formula of taking rewards, buyback and collateral adding feature will be released soon. Stay tuned and keep looking up.

Purpose: Utility token to be used playing or using babylonia.app services

Total supply: not capped Fixed ratio vs. BUSD or USDC or USDT of : 1000 CHP = 1 USD Can be purchased directly or be airdropped with staking PBTM Daily airdrops to the PBTM holders: airdropped CHP can not be sold without playing at least a game and winning Credits (CRD).

Airdrops formula: fixed amount + proportional to the BABY Token amount, airdrops do not add up, there will not be an airdrop if the player did not use yesterday airdrop. Air drop mechanism: either by creating intermediary + auto-expiring token or algorithmic logic-check. Everything is under development.

Purpose: Utility token to be used cashing out or converting to other tokens The wining prize is paid in Credit (CRD) & Credit can be converted to Chip (CHP) to ensure continues game playing

Total supply: not capped fixed ratio vs. BUSD or USDC or USDT of : 1000 CHP = 1 USD Can not be minted, can not be purchased, can be swapped with CHP, BABY token or USD. There is a limit on the amount that can be cashed out, time-limit + cashing-out-limit Large swaps and cash-outs must be verified by admins. There will be an anti-cheating mechanism monitoring each player transactions at the end of each session to verify input and output of the tokens.

We not believe and trust the automation without proper scrutiny and examination. The main problem on the DeFi today is an absurd number of exploits, hacks, and frauds due to overestimation and trust to the code. In Babylonia, we believe that there is not a golden solution to everything, and the path to automation must be traveled slowly and carefully. Shortly, we do things mostly manually. So expect to hear more accountability and responsibilities and less “oops there was a bug in the code!”