This repo is for the ETH_Shanghai hackathon demo of YexLab.

We present Batch Swap, enhanced by Chainlink Automation. It is anti-sandwich attacks, order-independent and uses AMM less to reduce slippage. It works just like a traditional swap in the users' view, all details are hind in the backend and automatically executed by Chainlink Automation.

GitHub • demo video • slides • demo page

There are two known problems with AMM:

When the liquidity depth is not enough, It will cause significant slippage in some transactions.

If two swaps with the same amount come in different directions at the same time, According to the AMM formula, It will return to the initial position, and the price of the first swap will be unfair.

This makes sense because the first swap bumps up the price and took the slippage, and the latter swap needs to accept the higher price.

If two people swap tokens in opposite directions with each other, then there will be no slippage. In reality. If person A has a large amount of the token to sell, let's assume this amount to be 1000 ETH, then the tolerance of person A to the big slippage is low because of the large value. If person A use a Batch Auction mechanism to swap, it would enforce this person A to wait for a while for a new person B to buy the ETH from him. this Batch Auction procedure can eliminate or reduce the occurrence of the slippage.

attackers exploit market and liquidity imbalances to execute profitable trades at the expense of victims or vulnerable traders. The attacker front-runs the victim's trade, hikes the prices, and makes the victim buy at a higher price.

The first transaction will bump up the price and let the second transaction(which we refer as the victim's)to be executed at a higher price. The attacker sells the token in the third transaction and takes the profit from it.

🥪 attack is a very common MEV approach that actually caused by the slippage of AMMs as well.

We call out our demo solution as Batch Swap, including three parts: Batch Auction, A2MM and Chainlink Automation.

Star with an easy example:

In a time window, some people want to swap LINK for USDT and deposit LINK into the contract, while others want to swap USDT for LINK and deposit USDT into the contract. We assume that there are 50 LINK and 1000 USDT in the contract, and the market price at that time is 1 LINK worth 10 USDT, then 500 USDT will swap for LINK directly while the other 500 USDT will be swapped in AMM.

We gather some random transaction demands within this time window, and exchange the symmetrical part directly, while the insufficient part uses AMM to fill the swap.

We practiced Batch Auction to extend the AMM. Batch Auction is commonly used in web2 exchanges to alleviate the problem of insufficient liquidity in commodities transactions.

We use the same idea, use a window of time to gather a batch of swaps and implement a unified clearing price for them, making them independent of the ranking.

The defination in Crypto Wiki is as follows:

-

Individual orders are grouped together into a batch and executed at the same time.

-

The same clearing price is assigned to all orders within one batch.

-

Trading in batch auctions helps guarantee fair price discovery and avoid MEV(Sandwich Attack).

The benefits of this are obvious, and direct exchange is always the most cost-effective method. This process is order-independent, that is, no value can be extracted by ranking a transaction to an earlier or later position.

But Batch Auction is not enough, if the demand is asymmetric, the excess demand will go to the AMM, which the attacker can still take advantage of.

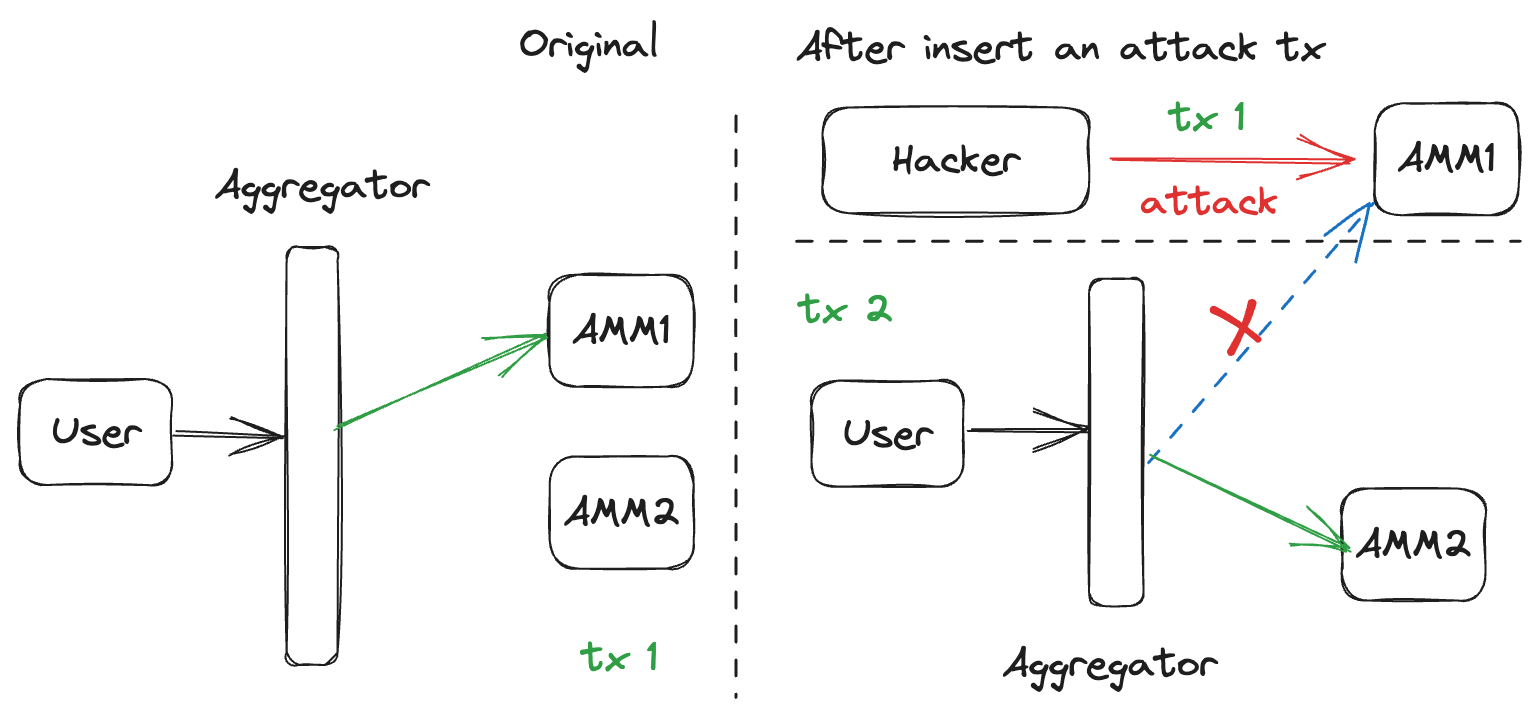

So we implemented an A2MM aggregator, that is, aggregated the liquidity of multiple AMMs, and only selected one with the best price when a swap execute. This means that an attacker would have to attack multiple AMMs simultaneously to affect this transaction.

As shown in the picture, the aggregator chooses AMM and does the swap in the same transaction, so when the attacker front-running the trader, the aggregator will choose another AMM with better price to avoid the attack.

Chainlink Automation is the infrastructure of batch swap:

- Create time windows and check that the swap volume and timestamp in a batch meet the requirements.

- Calculate the best price AMM then to do swap for tokens to balance demand.

- Automatic distribution tokens -- users do not need to wait for results and claim tokens, tokens will be automatically withdrawn to users' accounts.

Chainlink Automation allows us to automate the process: control the swap, choose the right time to match the balanced demand directly, and choose the best AMM to swap the excess demand.

Finally, Chainlink Automation can also automatically distribute tokens, letting users free from a claim. This minimizes the gas fee on the user side and achieves the best user experience by reducing the number of interactions.

This process is divided into two parts. First, a transaction initiated by a random user activates the contract and starts timing, waiting for the counterparty to enter for a period of time.

Chainlink Automation is the controller of the entire process. If there are enough counterparties, the waiting time will be shorter, otherwise, it will be longer, but there is always an upper limit.

When the time is up, Chainlink Automation will call the contract automatically to swap the symmetrical part, and to swap the remaining part by AMM. Selecting AMM and executing the swap is in the same transaction, so others cannot insert a transaction in it. And the contract always chooses the AMM with the best price.

Finally, Chainlink Automation will automatically distribute the tokens to the user, and the user does not need to claim them.

In our demo, the price is obtained by sorting multiple aggregated AMMs. If we have more time, we also hope to obtain a reasonable price through Chainlink Price Oracle.

YexLab is a research-based team that focuses on the prototypes of DeFi and DAO products. We will deliver the customized Batch Swap solutions for our partners Splatter Protocol and Honeypot Finance.